Prudent Valuation

The European Union’s Capital Requirements Regulation – CRR defined under Regulation No 575/2013 – defines the requirements relating to prudent valuation (PRUVAL) adjustments of banks’ fair-valued positions. The purpose of the regulation is to mandate banks to set capital aside for the “uncertainty” of valuations that are inherent in the mark-to-market and mark-to-model approaches used by trading institutions.

Regulation becomes law

The regulation became law in 2016. Banks are now expected to comply with the Regulatory Technical Standard (RTS) that the EBA published on the back of the regulation.

In proposing the regulation, the various bodies responsible for regulating the banking industry rightly concluded that the use of

- a single mid price or

- a single bid-offer spread or

- a single valuation produced by a model

does not capture the uncertainty inherent in valuations. The RTS, therefore, mandated a number of approaches under which banks would calculate ‘Additional Valuation Adjustments’, which in aggregate would determine each bank’s PRUVAL capital charge.

The two AVAs that require heavy use of market data are Market Price Uncertainty (MPU) and Close Out Costs (COC). At the end of each quarter, banks are required to obtain market data from as many contributors as possible for each instrument. The MPU and COC AVAs are calculated statistically using the distribution of contributed prices available for each instrument. The EBA requires that banks use the 90th percentile contributed price when calculating the AVAs. If the percentile approach is not possible due to insufficiency of available market data, a standard deviation approach is allowed.

Reviewing the process

In June, 2016, the Bank of England’s Prudential Regulation Authority (PRA) produced a paper entitled “Regulatory Update on Current Valuation Topics”. One of the themes of this paper was that while firms are for the most part are complying with the RTS, many of them have PRUVAL processes in place that are very manual. A lack of interconnectedness between PRUVAL processes was also a theme. For the PRA to have confidence that a bank’s PRUVAL is being applied accurately and consistently the underlying data sources, processes and calculations need to be auditable. Manual approaches, while getting banks across the Jan 1st regulatory finish line, are not seen as a sustainable way forward.

Keys to success

As firms look to move from manual, operationally risky processes to more automated, robust and efficient frameworks, GoldenSource has identified the key data capabilities required for success:

- risk sensitivity storage and aggregation

- multi-source and type pricing, rates and curve data availability

- price, curve and surface time series data with supporting market data manipulation capabilities

- AVA calculations for Market Price Uncertainty, Close Out Costs and Unearned Credit Spreads

- easy integration with security master and customer master systems

- an industry standard data model underlying all the systems and calculations

This adds to the list of financial data capabilities needed to comply with regulations and operational business as usual. There will certainly be new regulations and also internal demands for deeper analytics, faster reporting and improved governance. It is critical from a data management perspective to keep a forward view on the quality, availability and preparation of integrated data around securities, products, customers, accounts, entities, transactions and corporate actions.

Prudential Valuations in FRTB?

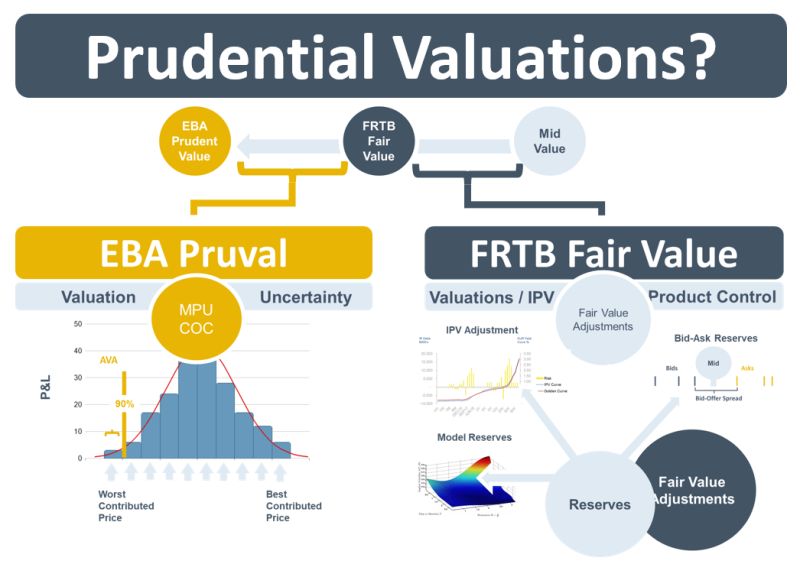

Prudent valuation is a term that is used in the context of a bank’s trading book more generally. Does the term have additional meaning? From a reg perspective, broadly the term has two meanings.

The first meaning relates to adjustments to fair value. Basel I, Basel II, and now Basel III (via FRTB) each had a section describing the need for banks to have prudential valuations. Banks typically will mark derivative positions at mid-price. These positions, however, cannot be exited at mid. They can be exited at bid or ask depending on whether the position is long or short. A bid-ask adjustment to P&L. The result is that the positions are held at their “exit” or “fair value” price. The prudential valuation guidance in FRTB also states that banks should make fair value adjustments for model risk, IPV, and other areas.

The second regulatory meaning of prudential valuations is the EBA prudential valuation framework, as described above. The diagram below illustrates the difference between the two regulatory concepts.

Accommodating PRUVAL

PRUVAL is one of many regulatory data challenges that can be accommodated within a strategic data management approach. Banks that assess the totality of their financial/reference/market/risk data needs can then make tactical adjustments or additions to a strategic capability, gaining incremental benefit as they go. This avoids the need to reconcile cross-regulatory and cross-departmental data at various stages during transaction, compliance, reporting and disclosure processes, which is disruptive to operations and reduces efficiency.

Contact us to learn more