View GoldenSource data management solutions for the investment management industry

View GoldenSource data management solutions for the banks and brokers industry

Your banking and broking data technologies need to handle speed, scale and granularity in a way that supports the logic of your use cases, making the best available data ready for consumption as and when you need it.

View GoldenSource data management solutions for the capital market service providers industry

With enterprise level managed data services, our clients develop new client revenue streams and systematize internal operations efficiency to increase operating margin. In today’s hyper industrious market, data is a strategic asset, not just an operational necessity. We deliver the gold standard of data to capital markets service providers globally.

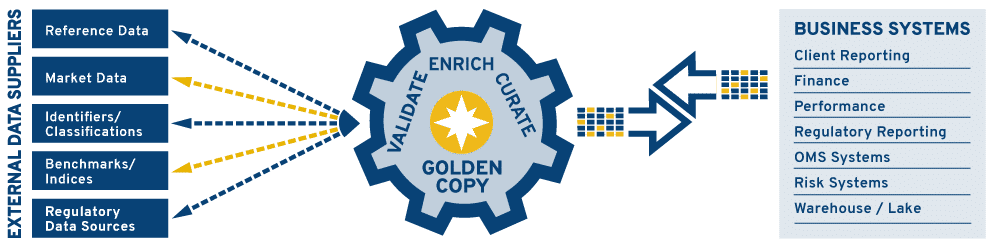

A blizzard of data from firms like Bloomberg, Refinitiv, and many others stream into financial institutions every second. Too often those institutions are forced to contend with inaccurate, redundant, and missing data managed by siloed teams and disparate systems. Managing that data so that it gives every user a “single version of the truth” is crucial in order to make smarter, faster decisions, address regulatory objectives, and make your day to day operations easier.

We’ve developed the data ecosystem required to seamlessly integrate with all major data providers, to receive and process this data, and direct it to the right internal systems so that you don’t have to. Providing the gold standard of Enterprise Data Management (EDM) and Master Data Management (MDM) solutions to global financial institutions has been GoldenSource’s core business for decades.

Each of our data management solutions is underpinned by the industry’s leading data model, making it a complete and robust solution for the type of data that specifically matters to you. When the time comes to interlink other data sets, our solution has you covered: Our product is built on a rock solid foundation onto which the data-specific modules can be added to scale up and configured for each and every client’s needs.

Engineered to the exacting standards and requirements of the financial world, GoldenSource Enterprise Data Management (EDM) solutions have been proven to deliver in the global market for nearly 3 decades.

Our exacting process of configuration assures timely implementation, and our fanatical support staff is by your side through every step.

Complying with ever changing regulations requires accessible, accurate data on the history of complex deals. Our clients need to be ready and confident to face an audit. We make sure they are.

Data management also impacts document management, compliance, regulatory outreach, client on-boarding, off-boarding and lifecycle management. Efficiency and information sharing between company sectors is essential to a healthy bottom line.

Delivering on ESG business and regulatory requirements is a key enabler for the financial services industry to influence positive environmental and social change. With comprehensive ESG data attributes baked into and cross referenced for securities, entities and products data management, analytics and reporting, GoldenSource EDM is truly ESG and sustainability enabled.

Using current technology in the financial market supports enterprise in organizing, managing and storing data efficiently. The benefits to the client and to their own clients is magnified. That’s why GoldenSource considers data management a strategic asset.

Strategic management of data gives businesses the ability to make fast, accurate decisions. It is also easier to respond to market changes, comply with regulations and be ready to face an audit with confidence.

Many financial companies have national and global offices. Consistency of data in various locations is a challenge. With EDM solutions, single-source reporting and multi-user capability gives clients uniform data in every location and department.

EDM gives asset managers, banks and insurance companies the ability to gain valuable insights into the financial history, current needs and market changes that affect the needs of their clients.

Armed with fast, accurate data, financial companies can forecast new business opportunities with greater precision.

Streamlining workflows has a huge impact on a company’s bottom line. Mistakes can be very costly, but data management lowers the risk of error through consistency and accuracy of information.