Even in an era of machine learning, automation and robotics, there is always a slim chance of an erroneous performance analytics feed, a wrong valuation file reported by a custodian, or wrong corporate action information delivered by a data vendor. The imperative is to fix these issues in the point-in-time historical record so that all the reports for that day show correct corporate valuation, performance and corporate action data. This can be achieved through the capabilities of a bitemporal data warehouse.

What is bitemporal data?

Bitemporal data denotes the values of a data type at different points in time. Bitemporal data is available in bitemporal databases and data warehouses to ensure that reports can be produced on a historical ‘as-of’ basis. When working with corporate actions or fixed-income securities such as bonds that have variable coupon rates, the concept of bitemporality has become key for managing the information about these actions and securities.

In financial trading operations, a bitemporal data management capability means being able to assign and manage multiple time stamps for the same item at different points in time. These can include data about conversion ratios, positions, portfolio holdings, exposure, ratings or a firm’s own classifications of a security or an action. With a bitemporal capability, data managers can more effectively identify and correct errors in their data, based on a history of that data item.

Many investment data types are dynamic and can vary over time. These include portfolio exposure, performance and risk measurements, ratings, classifications, and statistical information such as coupon rates, analytics and ratios.

Bitemporal data for reporting

Bitemporal data systems are necessary to handle these many areas of dynamic or volatile data, statistics and analytics, in order to achieve better and more accurate management information (MI) and financial and regulatory reporting. That higher standard of reporting will better support risk management, regulatory compliance and performance attribution.

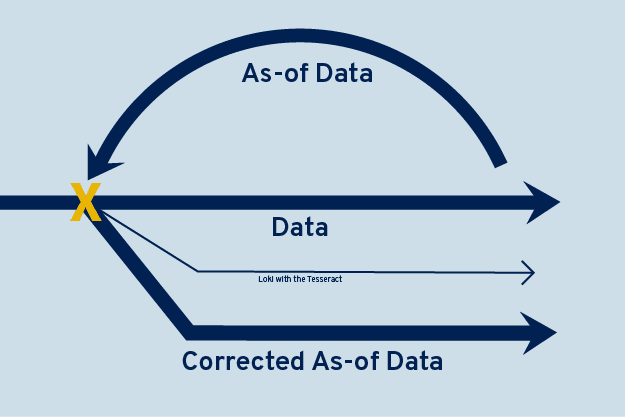

Having such a bitemporal record of key data and changes to that data is indispensable for reporting, auditing and regulatory requirements. Errors in attributes such as bond coupon rates or conversion . Even better, this information can be corrected while retaining the history of what these items were believed to be at past points in time. This allows user to look back in time and perform analysis based on the lineage and ensure compliance. Aside from error correction, using a bitemporal data management capability also allows firms to see how a security was valued at a certain as-of in history vis-à-vis how that position is valued after adjustment as at the current date. For example, it allows users to factor in late arriving trades or make adjustments while finalizing the end of period accounts, such as P&L and balance sheet. It is able to provide a true picture, because it maintains the entire life cycle of a trade or adjustment.

Reference to a point in time

Each recorded snapshot of a data element can be called an as-of, as in ‘these were the values for the data element as-of a certain point in time.’ Changes in this data may or may not happen each day, so data consumers may want to specify that they only want new as-of snapshots when there is a change. Still, each change requires all the relevant data to be stored all over again in the snapshot. Matters get more complicated if data consumers are dealing with multiple vendors or sources of bitemporal data. GoldenSource natively handles multiple vendors and stores the relevant bitemporal data at the same time. This helps capital market participants to effectively manage their data and risk. It provides a complete, correct and authoritative picture of data at different point in time. It produces time-based insights from data for highly regulated capital markets.

Warehousing the appropriate data to perform the kind of functions that achieve true bitemporality can be a challenge, as can having the correct technology to track what is happening bitemporally in securities data. The GoldenSource Data Warehouse supports bitemporality, providing users the ability to maintain historical data while relating it to market changes, and recording such changes correctly. This approach gives confidence to any regulatory authority, auditor or internal reviewer/approver of the data, because all history, both the original view and the corrected view, is available to them. Operationally it allows firms to correct manual errors, late trades and make adjustments in a controlled and governed environment.