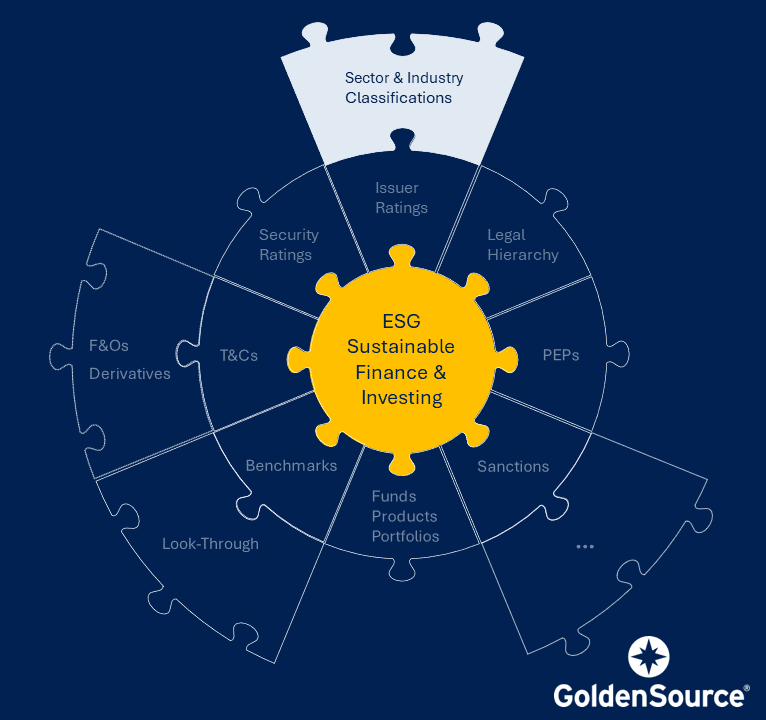

Building an ESG-focused investment portfolio requires constant vigilance, and one effective way to help ensure a portfolio is meeting your criteria is to perform analytics using adjacent data sets such as sector and industry classifications.

Those criteria may include, for example, balancing the composition of the portfolio with certain percentages of industries or regions, or identifying non-compliant culprits, or providing reporting on energy consumption intensity within high-impact climate sectors across different jurisdictions – all of which means you need multiple classification schemes.

The thing is, there are a LOT of different industry and sector classification schemes out there – such as GICS, ICB, NAICS, or NACE – and each of them has its purpose, its promoters, and its adopters. As a result, many of them need to be used in conjunction with each other, particularly if you need to adhere to different regulations across jurisdictions.

And just as there are many classification schemes, there are many ESG-based disclosure criteria demanded by various regulators around the world. But by taking a truly generic approach to centralizing data, it’s possible to handle and validate multiple classification schemes, even proprietary or in-house ones that deal with very specific kinds of sector or industry information.

Working with numerous sectors and industries across multiple jurisdictions can get very complicated very quickly. With the ability to understand and work with classification schemes, you can help ensure you’re getting the biggest, clearest picture as you continue to fine-tune the makeup of your ESG portfolios.