One of GoldenSource’s newest ESG Hubs for the cloud warehouse is for climate risk data.

More specifically, it’s for climate-based physical risk – data that provides insights into how a company (as the owner of its properties) or an entire portfolio of investments is exposed to the consequences of climate change. This is data generated by various agencies – some of which also provide credit risk analysis – that is used to perform risk projections and assessments vis a vis the economic outlook of an investee or entire portfolio.

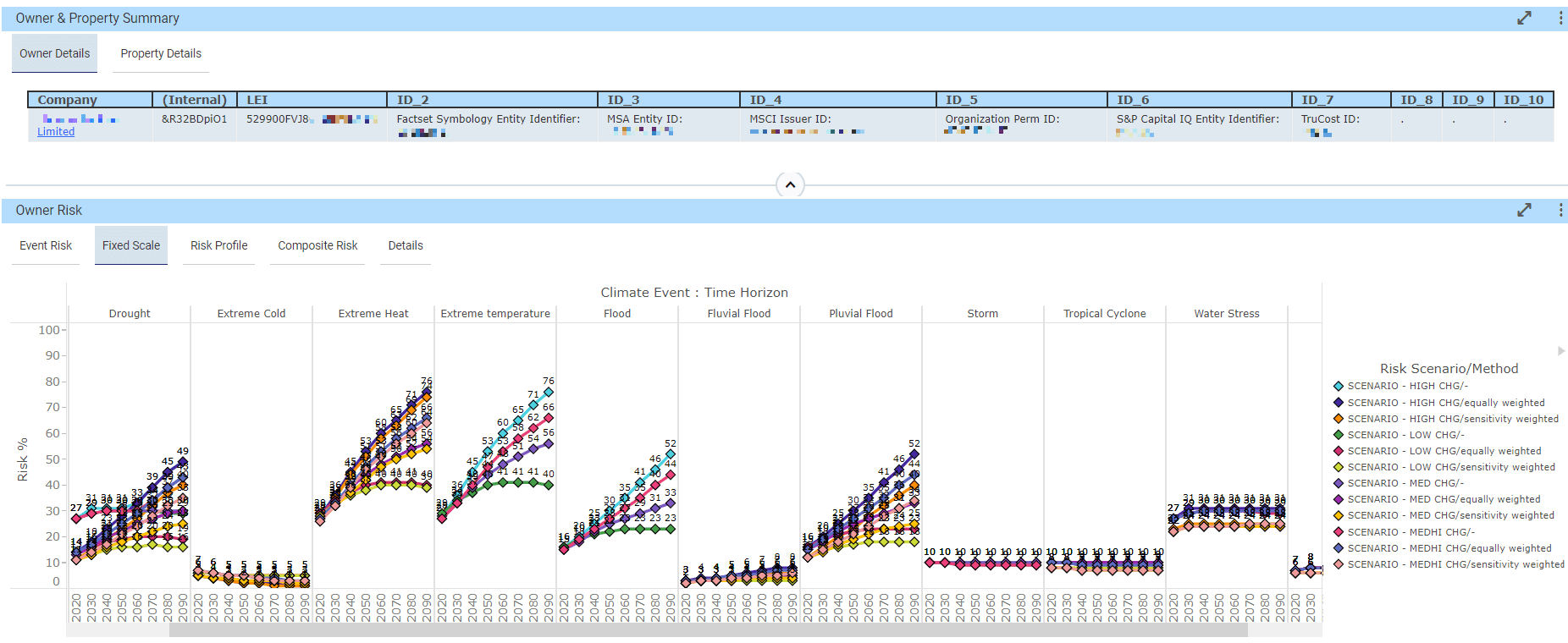

Looking at this data, it’s possible to make certain risk assessments based on low, medium, medium-high, or high climate change scenarios. There are composite risk assumptions that can be made, too, based on various projected climate events – for example, floods, extreme temperatures, storms, wildfires, and droughts – and how combinations of them can disrupt a company overall.

The task, of course, is to determine as accurately as possible the mid-term and long-term adverse effects climate conditions may have on a business, and whether there are investment alternatives that increase the likelihood a portfolio will meet its performance target.

For example, if you’re looking at an agricultural company and determine it has farmland that could be susceptible to drought in five to ten years, that will influence your – and others’ – investment decisions. The same principle applies to a company with a manufacturing facility in an increasingly high-risk region where workforces, for example, are becoming harder to recruit.

The fact is, that many climate changes are happening even faster than what was initially projected. As a result, they are having a profound effect on the way portfolio managers are assessing potential investments and complying with industry recommendations and their custom base’s expectations concerning climate-related disclosures. As a result, there is increasing interest in accessing the most comprehensive data possible.