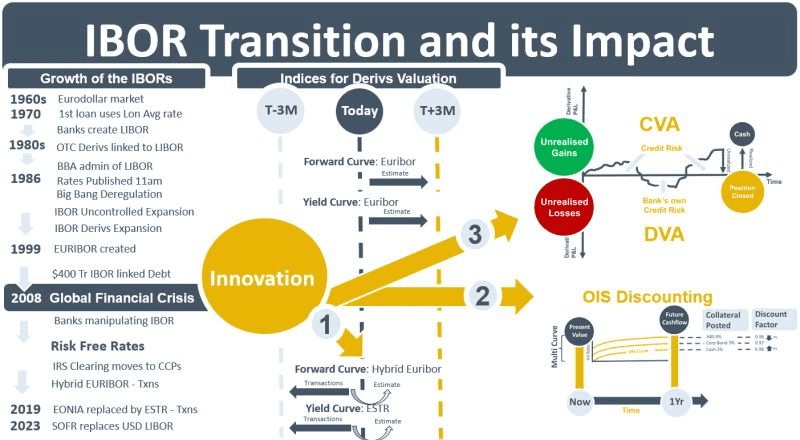

In recent years market data analysis requires an understanding of the IBOR based rates, their risk-free-rate (RFR) replacements and IBOR fallback rates used as interim solutions while IBOR is being phased out. This week’s note discusses the background to IBOR and the impacts that the transition to RFRs has had on derivative pricing approaches.

In 1970 a syndicate of international banks arranged a loan to Iran for telecommunications infrastructure investment. It was a floating rate loan linked to an average of London interbank lending rates. The average rate was the first LIBOR index. Global capital markets, shut down since the 1929 stock market crash, had begun to open again. New IBOR indices evolved to meet demand for floating rate loans in recycled offshore dollars that were funding global investment.

The use of IBOR indices expanded rapidly, far exceeding their original intended use. Commercial and retail loans, mortgages, bonds of all types, money market instruments, exchange-traded and OTC derivatives were all linked to IBOR indices. The price of debt for the world had become dependent on rate submissions to IBOR panels performed by a small number of banks.

The global financial crisis of 2008 was the beginning of the end for IBOR rates. During the crisis interbank lending was replaced by central bank lending and secured lending was preferred to unsecured. IBOR-submitted rates at that time were therefore inaccurate, unsubstantiated and manipulated to suit trader positions. The valuations of hundreds of trillions of dollars of global debt and derivatives were impacted.

The solution was risk-free rates (RFRs). IBOR submissions for the coming 3–month or 6-month period were replaced by rates calculated using overnight rates obtained from prior period transactions with daily compounding used to derive a rate applicable for a future period. Overnight rates have only one day’s credit risk, so the rates are deemed risk-free.

Derivative valuations is a two-step process: 1) Predict cash flows created by changes in an index, 2) discount the cash flows to present value using risk-free rates obtained from a yield curve. Prior to IBOR transition, IBOR indices were the basis for both steps. The move to RFRs, however, triggered innovation that impacted these steps. First, a new set of index calculation and settlement conventions was developed to adjust for the backward looking, overnight-compounding RFRs. Second, the replacement of the single IBOR-based yield curve for each currency with an OIS discounting approach that added a credit spread to each currency’s overnight index swap (OIS) curve depending on the quality of collateral posted. A third, related, innovation was developed for uncollateralised derivatives. An upfront adjustment to the mark-to-market $valuation of the derivative was required to adjust for the credit risk of in-the-money positions. The adjustment is referred to as the credit valuation adjustment (CVA).