We have arrived at that time of year again when many holidays are being celebrated around the world. Just this Friday, for example, Diwali is observed at major Indian exchanges and All Saints’ Day closures will occur in many European markets.

That gives me a good opportunity to talk a little about financial calendars which are often neglected when planning security or price mastering solutions – neglected, but essential. Take a close look at what these solutions require, and it quickly becomes evident that they can only function with access to accurate, up-to-date exchange calendar data.

Calendar data has many uses in security and price mastering, including:

- settlement holidays for settling/clearing on a particular exchange

- currency clearing days for FX trading

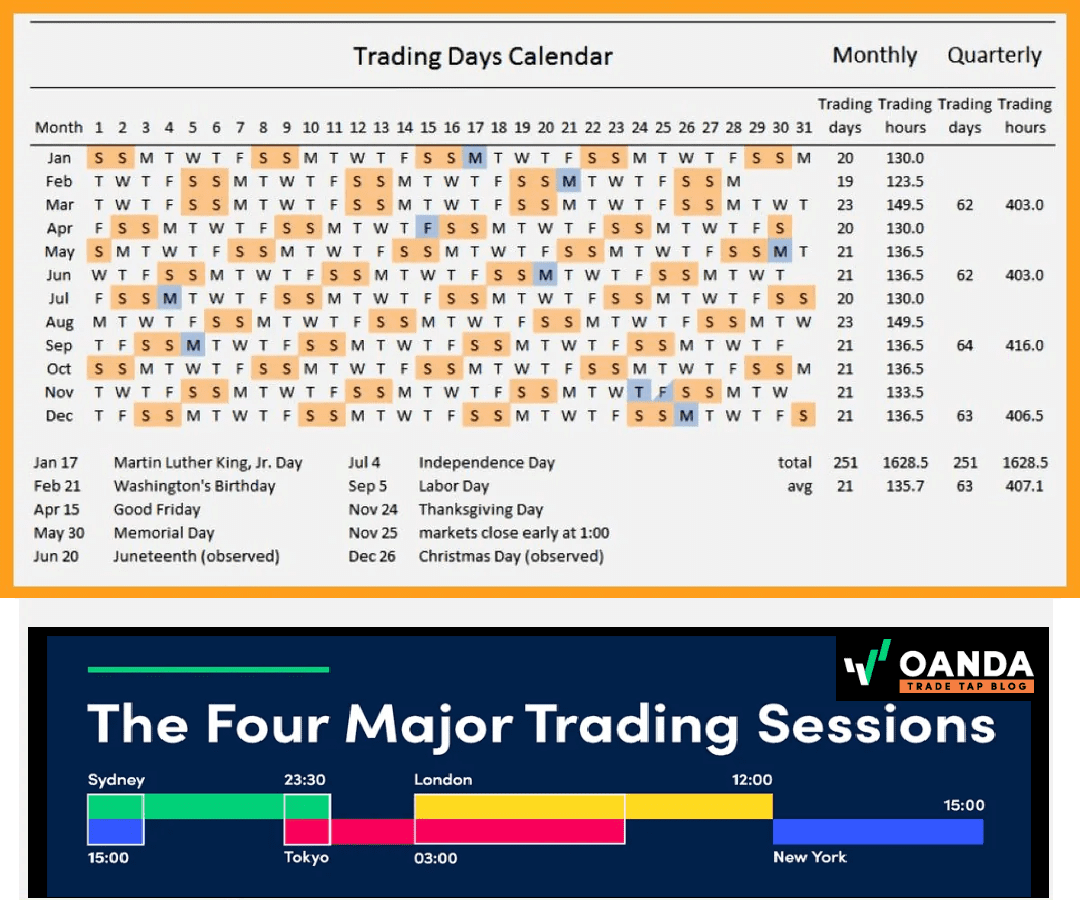

- trading times – opening and closing days, sometimes also requiring the exact trading hours

- pricing models – valuations and pricing calculations require the accurate number of trading days

- risk management – e.g. for time-sensitive Value at Risk (VaR) calculations

- portfolio strategies – rebalancing schedules needed to know when markets are open.

So, calendar data is not quite the side issue as it first may appear on the surface. In fact, because market closures affect liquidity, trading volume, and price volatility, calendar data provides important insights for investors and asset managers for planning trading activities.

It can also get complicated. Each exchange has its own calendar, which dedicated calendar providers such as Copp Clark and Swaps Monitor Publications (both of which partner with GoldenSource) often anticipate for 30 years rolling.

However, not all holidays are known in advance. For certain national or regional holidays and special observances, closures can happen unexpectedly and are announced at the last minute. Half-day holidays can result in early closures. Disasters such as extreme climate events can also result in exchanges being closed. And sometimes, you simply need the ability to make manual changes to ensure updates are reflected.

The key is also to have the means of aligning or linking calendars (aka “holiday centers”) with the specific exchanges as referenced by your other data providers for instrument market data. This way, you avoid the risk of missing critical transactions right at the time they are expected to be made.