A couple of weeks ago, I talked about making sure you have the means of aligning or linking calendars (aka ‘holiday centers’) with specific exchanges as referenced by your data providers for instrument market data. The thinking is that by doing so, you avoid the risk of not performing critical or mandatory transactions at the specific times they need to be made.

The same alignment principle applies to exchanges.

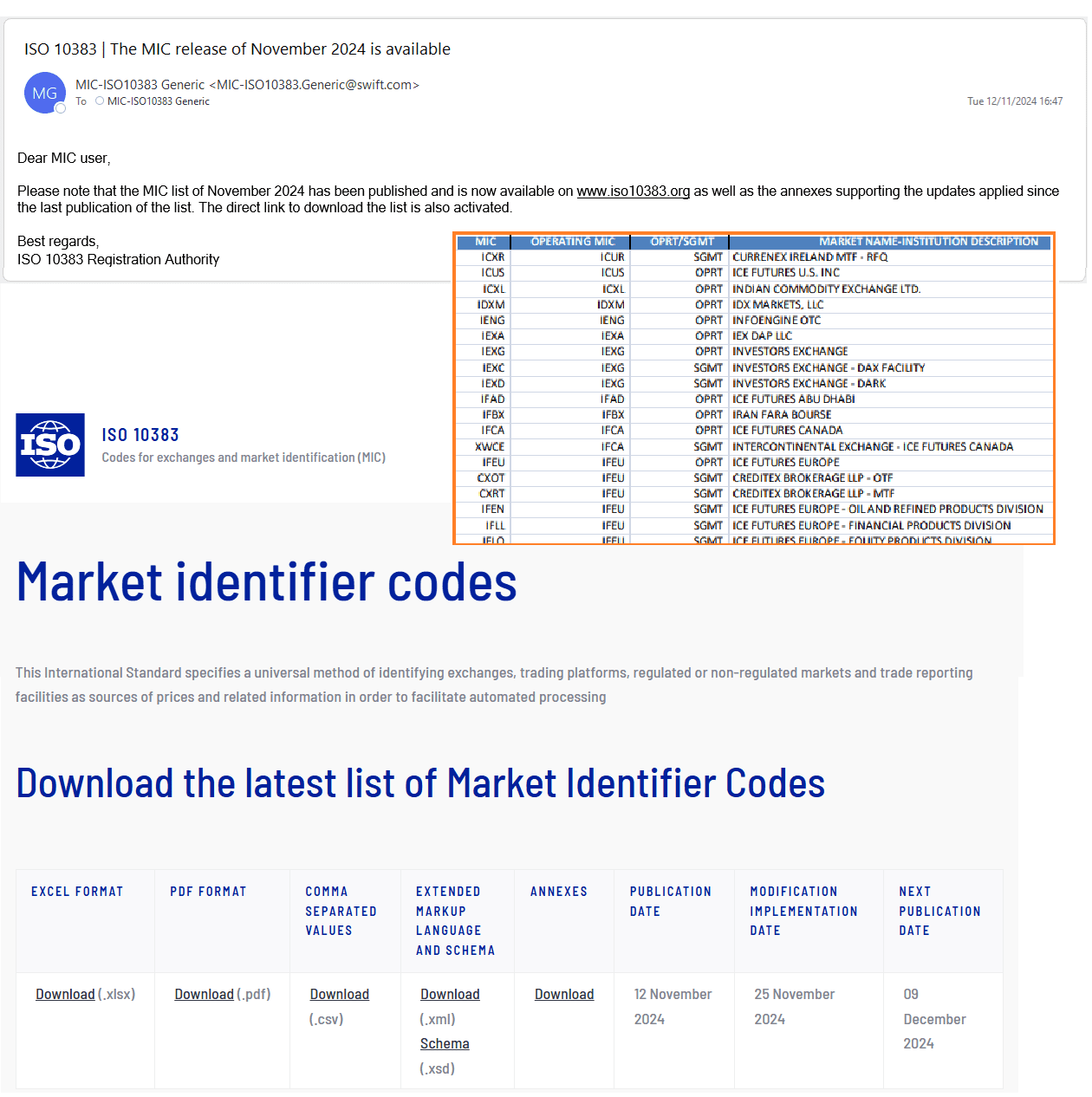

The ISO 10383 standard for Markets is the established system for identifying exchanges, trading platforms, and other market entities through unique identifiers known as Markets Identifier Codes (MICs).

An ‘Operating MIC’ may have several ‘Segment MICs’, each of which has a certain purpose, and each of which, may be regulated differently. There is a monthly publication that alerts the industry of the latest additions, removals and changes within MICs.

At the same time, data providers have already established their own records for exchanges – their own proprietary exchange IDs. For example, there are exchange IDs from Bloomberg and LSEG (previously Refinitiv), among others. These exchange IDs reflect their respective vendors’ views and granularity of markets and exchanges, down to the desk-level.

In addition, there are ‘Composite Markets’, each of which represents an entire region such as a country or a supranational unit. Those may not be assigned a MIC but comprise a number of MIC markets themselves.

Hence, typically we are confronted with a network of exchanges, many of which are identified with standard exchange IDs as well as multiple proprietary exchange identifiers. This is where a MIC market can correspond to one or more proprietary exchange IDs, or a proprietary market for a certain purpose may not even have a MIC equivalent.

So, in order to have a robust and consistent security master and market data management, an alignment process is clearly required. You don’t want to end up with duplicate listings in your database, which in reality are one and the same because they are actually traded on the same exchange.

The said ‘holiday centers’ for financial calendars is just one out of many use cases that rely on this continuous alignment service to be sound and bulletproof.