In this, the first in my series on credit ratings, I want to take a look at the various kinds of credit ratings that our clients typically employ.

Just to frame the conversation, I’m leaving credit ratings of individuals as well as sustainability ratings aside. Investment Risk Ratings such as VaR – Value at Risk – fall in a completely different category as well. Instead, our focus here is on classic credit ratings – that is, those applied to an entire company, a sovereign security, or a specific security to meet its debt obligations.

To understand the creditworthiness of a corporation itself and its equity, Issuer Ratings are typically used. (These are also known as Company Ratings or Organization Ratings.)

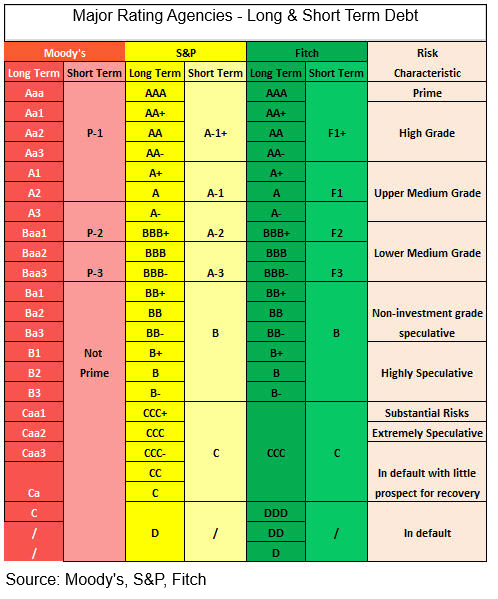

To understand a particular bond’s risk of default, rating agencies offer Instrument Ratings – also known as Security or Bond Ratings – for corporates and countries alike. These are determined with different time horizons in mind – Long-Term Ratings or Short-Term Ratings – and concern instruments that stretch over more than a year.

Near-Term Papers and Loans, by contrast, usually have a different scale than Long-Term Ratings.

Those ratings, in their narrow sense, can come with the very important but less well-known additional aspects of the rating’s ‘Outlook’ and ‘Watch’ – signals that rating agencies provide to indicate potential changes of that rating in the future.

While not a firm announcement of a rating change, Outlook and Watch signals enable investors to anticipate movements ahead of an actual rating change itself.

The Outlook is a broad, mid- to long-term view of the rating, detailing whether it is stable overall, or is trending in a positive or negative direction within the next year or two.

The Watch is a more imminent signal that is taken from certain new developments such as an upcoming merger or a crisis in the company’s sector. It may indicate a change within months or even weeks.

Furthermore, if one needs to look at ratings with a strong regional or national focus, there are flavors of ratings that consider local risk factors as well.

At the same time, there are composites of these ratings that are constructed by redistributors.

No question, there is a broad range of credit rating data points to choose from with a lot more granular information and related metadata available to facilitate deeper interpretation and determine to which investment is the best candidate for a portfolio.

Next week, I’ll take a look at what the market looks like for ratings providers and agencies.