Credit spreads are an important category of market data. They are used to indicate the level of default risk in a bond. They allow investors a means to compare the relative value of corporate bonds. Credit spreads are also the main pricing fields that are used in proxy pricing approaches. This week’s note provides a short history of credit spreads from their beginnings as treasury spreads.

Debt instruments have been used since antiquity. The earliest known bond was a stone tablet used in 2,400 BC in Nippur in Iraq to record a liability in grain plus interest. Government bonds were first issued in Venice in the 1100s to finance a war against Constantinople. Bond trading markets emerged in the middle ages in Italian city states and feudal economies in Northern Europe. In 1789, the US Treasury dept was formed to issue gov bonds. The financing of the Civil War, World Wars I & II, and public investments caused UST issuance to increase to $260 bn. Today, UST bonds in issuance = $40 tr. USTs are considered risk-free investments because they are backed by the US government.

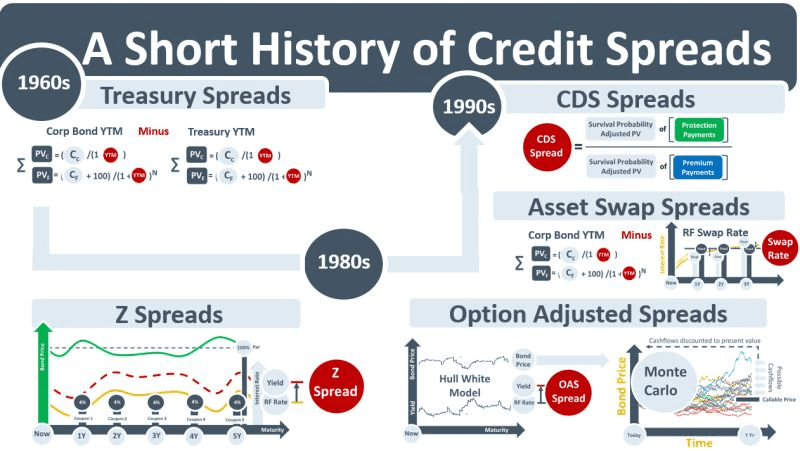

The first corporate bonds (CBs) were issued by the Dutch East India company in the 1600s to obtain funding for its trading ventures. The joint stock company grew from these beginnings to become the foundation of capitalism and globalization. The global CB market today is equivalent in size to the UST market. CBs, unlike USTs however, contain credit risk. The diff in YTM between a CB and a UST = the treasury credit spread (CS). A bond’s YTM = the single yield that makes its discounted CFs = to its market price. Informal use of the treasury CS began in the late 1800s as CBs were used to fund industrial expansion. By the 1960s their use was fully incorporated into bond relative-value analysis.

The term structure (TS) modelling techniques of Vasicek, CIR and others arrived in the 1970s. They modelled a RF yc used for estimating and discounting a series of uncertain forward-dated CFs of bonds and their derivatives. TS models were the catalyst for more advanced techniques for deriving CSs.

In the 1980s & 1990s, four approaches evolved for deriving CSs. The first was the z-spread. This was a fixed, i.e., zero-volatility, spread that was added to the RF yc to create a set of DFs applied to bond’s CFs to generated its price.

The second was the OAS spread. This was a CS that accounted for the fact that callable bonds contained embedded options that impact the bond’s price. The embedded option could now be valued using the newly developed TS models. The OAS technique removed the value of the embedded option from the bond’s z-spread to arrive at the OAS spread.

The expansion of the IR swap market in the 1980s created a framework for the third CS derivation approach, the ASW spread. An IRS allowed investors to swap a bond’s floating rate for a fixed rate. The diff btw the bond’s YTM and the RF rate used in its hedging IRS = the ASW spread.

The development of credit derivatives in the 1990s allowed investors to isolate and hedge the CS risk on a bond. The most prominent credit derivative was the CDS. The CDS spread, the fourth type of CS, is an insurance premium, measured in bps of the bond’s notional, paid to a third party to insure against default of the bond.