Asset Management operating models have been evolving since the 2008 financial crisis. Data management has been a small component of this evolution, but could soon erupt, with ongoing cost and consolidation concerns serving as a catalyst.

Shifts in both fee structures and changing investor preferences are affecting firms’ operational resources. Fixed-income managers have had to lower the fees they charge due to ongoing lower yields, and actively managed equity have had to lower their fees to compete with Exchange Traded Funds. Whereas a large-cap growth or value portfolio with engaged, active management can charge upwards of 100 basis points or more, an equivalent market cap weighted Exchange Traded Fund (ETF) can charge a fee in the single-digits basis point range.

Consolidation among asset managers has been happening over the past decade or more, but the past year or two has seen a spike of consolidation among the largest ones. Invesco and Oppenheimer Funds merged, Morgan Stanley acquired Eaton Vance, and Trian Fund Management increased its stake in both Invesco and Janus Henderson. This type of consolidation often requires assembling a patchwork of technologies, distribution methods and investment strategies into a coherent target operating model to realize the benefits of the combined organizations.

Market-leading asset managers are staying ahead of the competition by adopting an assembly line approach to their operating model. This model starts with a team of investment strategists and product managers who devise new products and determine asset allocation, portfolio management and trading to implement these strategies, and distribution services to promote these products and generate client acquisition. This assembly line model is now used by many of the largest tier 1 and tier 2 firms. Firms are finding that when they have incorporated a data-centric approach into this type of operating model, it minimizes disruption when they have to respond to new business and regulatory requirements.

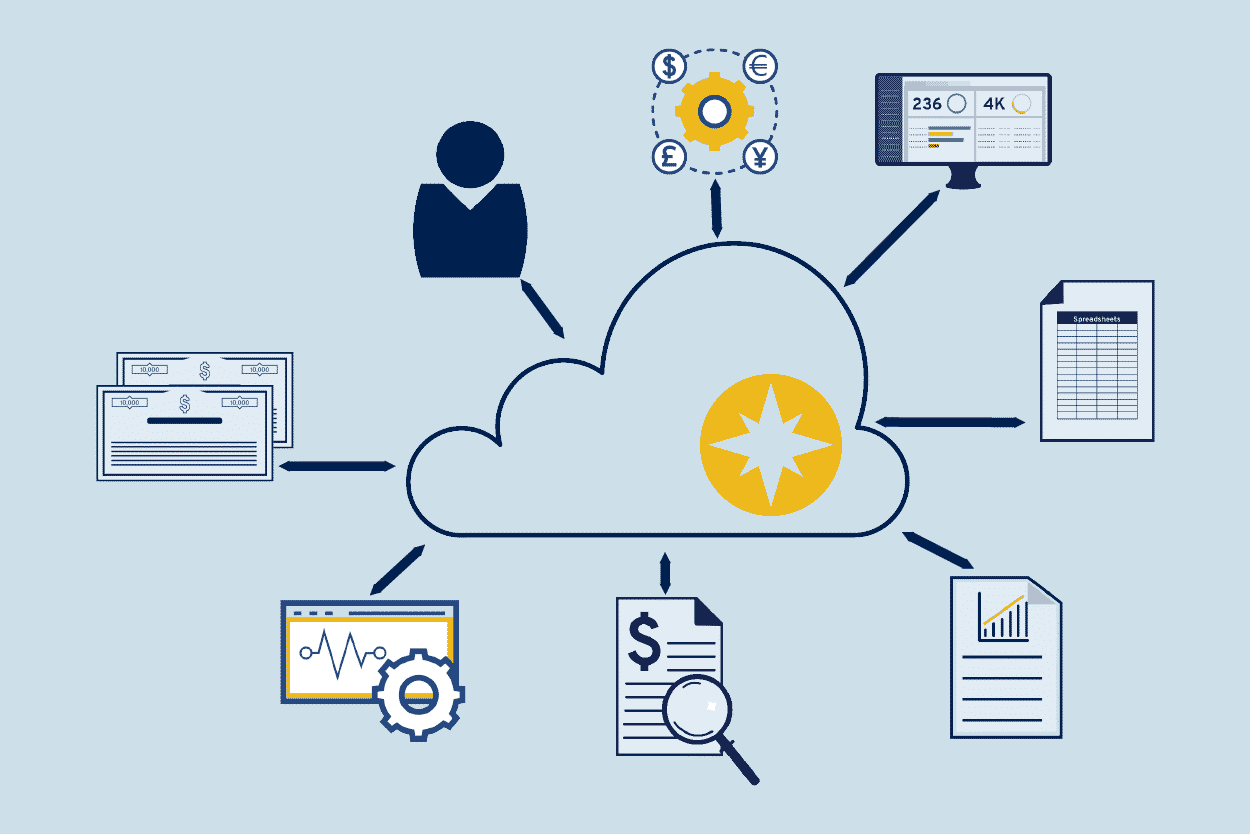

Still, the data needed to feed these assembly line-generated products has to come from many disparate sources to cover the range of required inputs. These include everything from pre-payment rates for mortgage traders to balance sheet information for fundamental equity managers. The economics of managing vendor data feeds are another big concern underlying the choice of operating model.

Over the past several years, firm-wide site licenses have given way to per-user models for data operations. Firms using a data provider that charges per-user have to get their data governance in order, including who will access the data and how the data will be curated and normalized so the firm will only get and pay for relevant data, and only from its preferred providers. On top of those choices, the consuming firm has to determine which managers need that particular data. The benefit of this specific set of data feed choices is that the firm can focus its data spending in the right places, rather than paying for a blanket broad site license for data.

What are the most convincing asset management operating model solutions?

Getting front-office personnel to accept the use of new technology for updated and upgraded asset management operating models is one of the largest hurdles to their adoption. This is a culture problem: Front-office personnel may resist dropping spreadsheets and established practices tied to their “secret sauce” for great investment performance. Firms certainly do not want to alienate these key members of their organization thus causing them to leave for a competitor firm.

There are some forward-thinking organizations, including hedge funds, who realize the need to change their operational models. Those who are on the cutting edge of technology have to coax the slower movers to get on board.

While all firms are looking for a fully integrated end-to-end solution that can cater to this new operating model, the current offerings cater to very large organizations. These platforms, which include a combination of enterprise investment management platforms, ancillary data and back office systems, require a large financial commitment that may not work as well for medium or smaller size firms.

Componentized systems, which are more appealing and flexible for these small and medium sized firms have certain pros and cons. The pros of putting multiple systems in place include flexibility to create a solution through choices of components that will best fit a smaller firm’s needs. The cons of putting together multiple systems for different functions include having more potential points of failure and having to deal with multiple providers and their system upgrades and support.

Along with those vulnerabilities of componentized operations, small firms trying to get new types of data sets have to be able to curate all that data and derive insights from it. That requires standardization, which can be addressed through a centralized data management platform that feeds the right data to all systems and teams that require it. Firms large and small can be assured that advances in asset management operating models capability go hand in hand with improvements in accuracy and quality across the business.