Fund Launches have been grounded

They say good things come to those who wait. This is not the case for investors if the slow growth in fund launch numbers the last two years is anything to go by. According to Statistica, the net growth in the number of open-end funds worldwide slumped in 2016 and 2017.

Was this the result of stretched valuations across multiple asset classes or an over-saturated market? Or was it simply a case of fund selectors waiting until the industry familiarised itself with the impact on regulations and trade relations resulting from a new US president and the subsequent America First policy? While it is hard to pinpoint the exact reasons, the fund manager and record keeper community shouldn’t use this downturn as an excuse to brush under the carpet the operational niggles that have historically hindered fund launches. There is still a need to address these underlying problems. A fund launch typically takes 6-8 months, whereas 2 months should be the target timeframe.

So what are the challenges? They essentially break down into two key areas. These are the use of outdated systems, with their manual processes and workarounds, and the challenge of mapping and managing different fund fee structures and account information and then linking that to the firm’s customer relationship management (CRM) system.

Relying on Old Systems and Manual Methods to Manage a Fund Launch

Take the problem of relying on old systems and manual methods first. Typically, a large-scale fund generator will have anywhere between 50 and 100 different people involved in launching a fund. The challenge is that numerous elements go into each launch. These include defining the fund, its strategy and target demographic. Then there is marketing the launch, not to mention legal/regulatory administration, writing compliance disclosures, as well as arranging the distribution strategy and setting the associated fee structures. From a governance standpoint, isolating the meta-data associated with the fund and identifying the fields on which management reporting will be based, is also necessary.

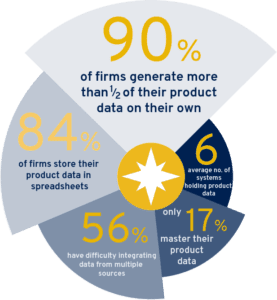

The trouble is that right now, too many of the major fund management houses have a cumbersome way of gathering all this information together, orchestrating it as part of the fund launch process and maintaining it. Currently, data is compiled in multi-tab spreadsheets or 20-page long Word documents. These are passed through many hands over email at various stages of completeness. A fund launch is a non-linear process. Teams work in parallel on inter-dependant elements of the launch. For example, the disclosures can’t be finalised until the fund strategy is approved, but preparation for both needs to occur in tandem. Think of all the headaches and document version control issues that arise from the constant back and forth between the fund and legal teams working on any wording corrections, risk profile and share class validations, or escalations of issues.

Also keep in mind that every regional jurisdiction in which a fund generator operates will demand some unique fund launch considerations and processes. For any launch across multiple countries, workflows will involve regional variations of similar steps.

Managing Fee Structures, Account Information and Interlinked Fund Launch Data

Once the launch preparation is complete, each department typically enters the information into their own systems. This results in another potential point of ineffectiveness. If these aren’t integrated the interrelationships and dependencies between the numerous data elements become disconnected. This impairs operational efficiency when promoting and running the fund.

And so, onto the second key challenge. On the ERISA side, fund managers and record keepers need to match and manage the plan sponsors and participants with the funds available. A difficulty is that the greater the variety of size among plan sponsors, the greater the amount of information and number of fee structures that need to be managed. Pre-launch, the future information requirements of plan sponsors, participants and registered investment advisors (RIAs) need to be documented and prepared for. This includes capturing relevant indices or benchmarks, such as fund statistics from Morning Star or Lipper. Managing and reporting the allocation of dividends or impact of corporate actions, as notified by custodians, is another example.

When targeting retail customers, fee structures are being squeezed while fund planning and launch is becoming more complex. Millennials are far more investment savvy and want more insight into where their money is going. They do not want to pay upfront management fees, rather they want to pay based on performance. Fund management firms need to document the key interactions and payment structures with their RIAs – who are responsible for selling their funds to the retail investor and smaller plan sponsor community. As part of the self-service expectations of today’s plan participants, the allowable number of movements between funds adds to the mounting pre-launch information check list.

Given the difficulties in linking differing fees and fund information to different accounts and the fact so many firms still operate on systems from a bygone era, how can fund managers overcome these long-standing issues when managing a fund launch? The answer lies in housing all information relating to a fund launch in a central data hub that is also being used to manage the operational data processes and flows between investment, performance, analytic and reporting systems. This approach also enables automation of the fund launch processes via workflows with built in controls and checks. This way, firms can ensure all activities and approvals can be streamlined much faster than through a spreadsheet or Word document. After all, these documents constantly need manually updating and are prone to version control issues that require subsequent remediation.

Automating the Process

Automating the fund launch process sets in motion operational efficiencies and reduces risks of errors from manual processes. On top of this, having everything in one place and feeding relevant information to sales, compliance, administration and finance from a common source reduces the chances of inadvertently selling an inappropriate product to a customer, the focus of the DOL Fiduciary Duty Rule, or struggling to reconcile information and reports.

Some fund managers and record keepers are improving fund launch processes as part of changes to their client, account and product (CAP) data management capabilities. These days it can be difficult to build a business case for change without a pending regulation to convince senior management of the urgency or importance. However, the need to reduce inefficiency and accelerate fund launch processes can be a compelling element of a business case that also aims to modernize product data management and reporting practices.

Despite the overall drop off in the rate of funds coming onto the market last year, the major houses still typically launch between 50-100 new funds every year. These range from funds with a new strategy, a new share class, such as crypto currencies, or the merging of two funds. Those fund managers that embrace the new solutions available to them will find that the operational headaches surrounding fund launch processes may soon be a dim and distant memory.

Contact us to learn more