Although the Basel Committee on Banking Supervision’s BCBS 239 principles for risk data aggregation and risk reporting (RDARR) took effect over three years ago, the financial services industry’s compliance is far from complete, despite improvements to data quality and tracking made by major institutions in the industry.

The BCBS 239 principles for effective risk data aggregation and reporting consists of 5 sections:

- Governance & Infrastructure

- Risk data aggregation capabilities

- Risk reporting practices

- Review, remediation and cooperation

- Implementation

Compliance with BCBS 239 Principles

As related in April by speakers and attendees at Marcus Evans Events’ Risk Data Aggregation and Reporting conference in London, global systemically important banks (G-SIBs), despite a great deal of apparent effort on compliance with the BCBS 239 principles, are still not getting much validation from regulatory authorities.

The European Central Bank (ECB) only considers one G-SIB totally BCBS 239 compliant, while one other G-SIB now says that it is partially compliant and moving towards receiving the ECB’s seal of approval for its efforts. As for the European System of Central Banks (the ECB and the national central banks) and its partners’ BIRD (Banks’ Integrated Reporting Dictionary) standard, as well other proposals for reporting standards, interest among influential financial industry firms is high, but none are getting a real endorsement from regulatory authorities. Regulators are not even acknowledging that firms are complying with such standards, despite their relevance to the BCBS 239 principles.

Alternative efforts toward standards

A couple prominent standards efforts, namely BIRD and the EDM Council’s FIBO (Financial Industry Business Ontology), are taking a different tack in their design, as an attempt to win over regulators’ hearts and minds. Instead of making the technology aspect of reporting their focus, BIRD and FIBO focus on building a common architecture and data dictionary as a smarter means to the desired ends.

A common architecture for compliance with the BCBS 239 principles isn’t as simple as it might sound. What’s needed is a flexible, standardized extensible architecture to manage and track data lineage. That is tougher to achieve solely with technology, or by putting an overlay on an existing architecture. The ECB has advanced BIRD, which is essentially a common data dictionary, as an attempt to set a universal standard for BCBS 239 compliance.

In effect, BIRD is a standard, rather than an architecture, to build on or at least base compliance efforts on. However, as a standard, BIRD gives regulators a basis for issuing new regulations and referring to those regulations. FIBO, for its part, is simplifying regulatory compliance, by making it possible to manage the data around financial instruments at great depth in a standardized way.

Proving adherence to regulatory standards

With the options of BIRD and FIBO, firms can prove to regulators that they have adhered to some standard. Also, if firms have implemented some kind of architectural and operational paradigm for compliance with the BCBS 239 principles, reporting becomes easier and they have more control over what they can do with the relevant data.

Yet, the ECB also has aspirations, shared at last month’s conference, for a shared architecture, which would negate the need for reporting as we currently think of it. Firms would not need to invest in multiple different architectures either, if this came to fruition, the ECB argues.

GoldenSource capabilities with BCBS 239 Principles

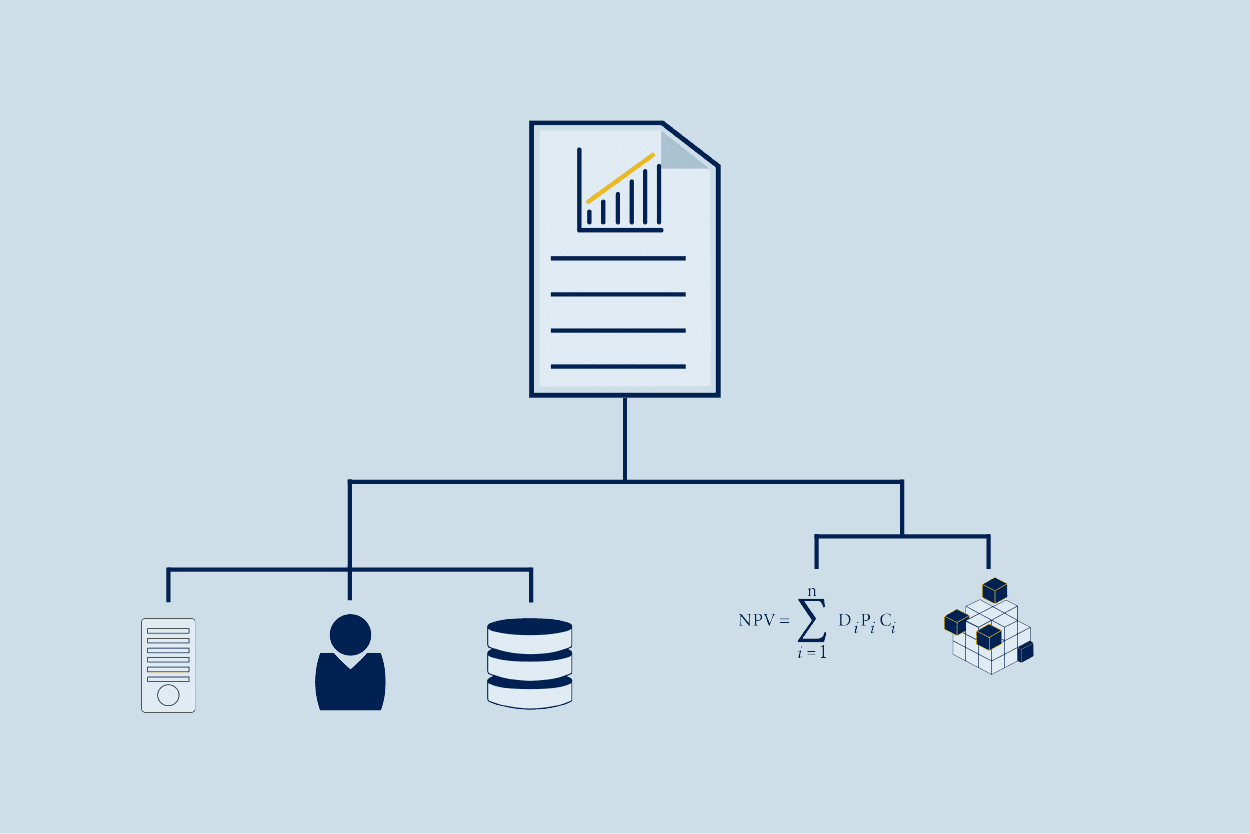

In the meantime, GoldenSource offers the capability and expertise for data mapping to standards such as FIBO and BIRD, and has become the de facto standard for about 30% of G-SIBs across various data domains notably Instrument data and Party data. Most G-SIBs are universal banks with multiple businesses including an investment bank, fund services and wealth and asset management businesses. Creating a single goldcopy to be shared by all business lines is achievable and has been achieved in several G-SIBs using the GoldenSource platform. GoldenSource’s meta data and data lineage capabilities are ideal to create a shared architecture for compliance with the BCBS 239 principles for risk data aggregation and risk reporting.

Even in this seemingly incomplete and messy compliance climate concerning risk data aggregation, regulators still expect quick and complete answers to inquiries. The standards and services available have gotten better, making it easier to offer at least some valid answer to a BCBS 239 principles inquiry.