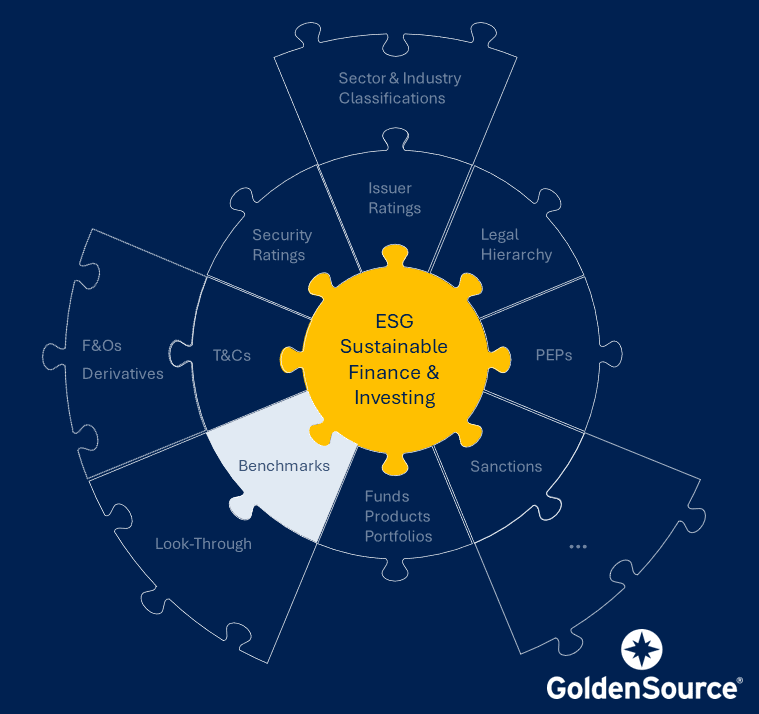

Over the past few weeks, I’ve been talking about the importance of using adjacent data sets that cover credit ratings, legal hierarchies, sanctions, and PEPs to develop, fine-tune, and maintain a viable ESG investment portfolio. This week, we want to look at benchmarks.

Benchmark data can provide a clear perspective into how an investee or a certain instrument is performing on ESG matters in relation to its peers and competitors.

Commercially available benchmark data from providers such as S&P, MSCI, Bloomberg, or Morningstar offers industry-specific indices and sub-indices with a wide range of ESG metrics. At the same time, you can also employ special-purpose ‘homegrown’ benchmarks that can focus on specific KPIs aggregated in-house.

In addition to assessing ESG-specific performances, benchmarks can also be used for proxying.

This is particularly useful when direct proxying from a parent entity in the corporate hierarchy is not possible, as is often the case with private companies. Whether environmental topics such as emissions, pollution, or land use or certain social factors, deriving a justifiable estimate based on that business’ industry and geographic engagement allows one to come up with a meaningful take, even if the reported data is not yet available.

Crucial for all interpretations is the accompanying qualification that those interim insights have been gained via proxying, as opposed to numbers genuinely reported by the company itself.

The purpose of using any benchmark adjacent data sets is to compose your own assessment of an instrument’s ESG performance based on whatever criteria you deem necessary. The other essential elements are ensuring that you are meeting the expectations of your sustainable investment clients and not failing in the regulatory requirements.