Getting customer data management right is critical.

While there are many reasons why, some big reasons include:

- Customer Satisfaction – All points of customer contact having at-their-fingertips visibility into all relationships between the customer and their institution provides for a better customer experience.

- Enhanced Sales – Complete customer relationship data provides the information needed to better determine upsell opportunities.

- Regulatory Compliance – Ensuring each customer has undergone KYC/AML and sanctions screening ensures compliance with all local and global regulations, thus reducing financial and reputational risk. And any fiduciary responsibility can only be fulfilled with the right customer information available to front office staff.

- Risk Management – A single version of your customer data with appropriate global identifiers (e.g. LEI) cross referenced to internal identifiers enables proper aggregation of exposures across the enterprise.

- Operational Efficiencies – Centralized client onboarding reduces redundant data entry and screening thus reducing overall operational costs and operational risk.

In all large financial institutions, customer data is only part of the story.

Additional data domains such as securities, positions and transactions, risk and market data, stored in a consolidated integrated data store along with customer data, are also critical to meeting the challenges faced by today’s financial institutions, including:

- Regulatory Compliance – Most new regulatory requirements including MIFID II and FRTB require consolidated data across the enterprise for all the data domains mentioned above.

- Risk Management – Under BCBS 239 all data used in risk management and finance must be consistent, with proven data quality and demonstrable data lineage back to the source of the information across all data domains.

- Cost Control – Every financial institution today is under pressure to do more with less. Key to making this happen is to reduce the number of redundant systems, processes and data flows that plague most large institutions.

While the benefits of creating an integrated customer data management architecture may seem obvious, actually implementing a consistent data governance framework with a single data repository across, or even within, these data domains, is a challenge with which many institutions struggle. In many cases, firms are trying to use generic cross industry tools, such as master data management (MDM) and workflow software to create custom solutions that try to solve financial industry specific problems. The result is long development cycles and eventually failed projects, as each bank must recreate the wheel with its own data model, workflows and business rules etc.

The true solution to this problem is to choose financial industry specific customer data management and client onboarding tools combined with a bottom up implementation strategy to tackle the problem in an incremental manner.

To begin with, using systems specifically designed for the financial services industry provides banks with a quicker time to value, lower risk and thus a lower cost solution than using cross industry tool sets. Embedded in these solutions is many years of business knowledge obtained from working with the largest financial institutions in the world. If a company elects to build this themselves they will be recreating the wheel. This work has already been done, incorporated into these systems and proven in demanding business-as-usual environments. The risk, if in-house developed tools fail to meet the business requirements, is of subjecting the bank to reputational risk and the financial exposure to fines. A sub-optimal onboarding capability will also prolong the onboarding process, involve more requests than necessary to the customer and delay the date at which a profitable business relationship can commence.

Learn more about Complex Client Structures in our whitepaper here

Why an integrated customer data management and onboarding solution?

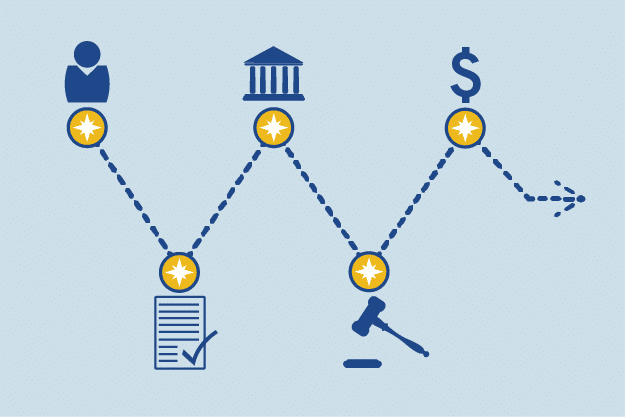

The fact is that all the data a financial institution needs to manage, for risk and regulatory purposes, is interrelated. Customers can also be counterparties and can also be issuers of securities that are traded by a bank. It is no longer practical to treat these as data silos. In fact, BCBS 239 requires that this data be treated in an integrated fashion, in part to ensure that the exposures associated with relationships, and the hierarchies of those relationships across borders or corporate group structures, can be aggregated and made transparent. At the same time though, there are very specific requirements for KYC and AML, which might differ substantially from country to country. This needs to be handled by a dedicated client onboarding solution. An optimal data architecture will cater for the universal interrelationships between the data domains and provide the flexibility for country specific rules for KYC and AML.

The final piece to this puzzle is how a bank can actually go about implementing this optimal customer data management architecture. In most banks there are multiple systems that store customer data, counterparty data, and related information such as standing settlement instructions, covenants and collateral agreements. It is unrealistic to expect that all systems can move to a centrally managed single source of customer and entity data all at once. What we advise is an approach where a single repository of customer and entity data is created, but an incremental approach is taken to converting to a single client onboarding process.

How does this work in the real world?

Take for example a large universal bank with operations in the US, UK and Australia. The first step could be a conversion of the client onboarding system in the US. At the same time, GoldenSource would undertake an exercise to consolidate all customer and counterparty information from the US, UK and Australia into a single golden copy, which would then be a master for all regions. This would provide the bank with a data isolation layer that, going forward, would make it easier to accomplish changes to the client onboarding functions in the UK, and Australia.

In summary, an integrated client onboarding and customer data management solution makes sense for any universal bank. The ongoing regulatory requirements such as FRTB, BCBS 239 and MiFID II have made an overall integrated data architecture a necessity, not a luxury.