There are volumes and volumes of company-level physical risk data being generated by numerous agencies, and the task for any portfolio manager – ESG-focused or not – is to derive maximum value from them.

So as a portfolio manager, what are the ways that you can approach aggregating this data to gain as much needed insight into the risk profile of an investment as possible?

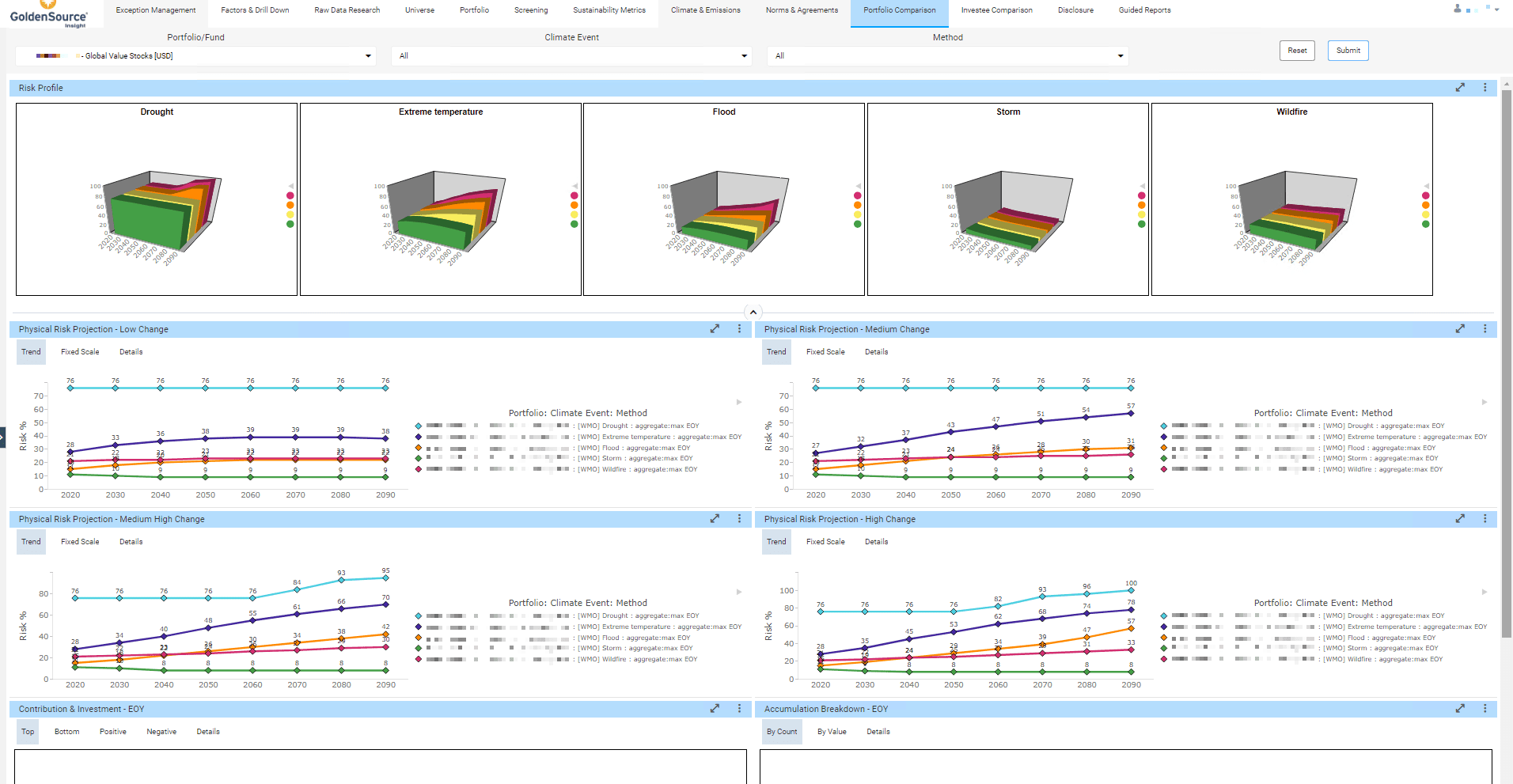

A fundamental decision is whether to look at the physical risk as a result of potential drought, extreme temperature, flood, storm or wildfire based on sector and sensivity?

In other words, how much consideration needs to be given to the company’s industry, and how do certain hazards affect that very type of business?

For example, potential drought is much bigger of a factor for an agricultural company than for, say, an IT consulting firm, even if they are located in the same geographic region.

Other aspects are whether an average or maximum risk approach is more applicable. Taking an average approach, the investment sizes are solely driving the level of risk the investor will be taking on. With a maximum risk approach, extreme exposure of some investments, particularly where highly sensitive to certain types of hazards, will strongly influence the determined overall portfolio risk.

Additionally, you want to look at different climate risk scenarios, near- and long-term, to make certain assessments.

Climate risk assessment agency maintain different types and levels of detail. For example, flood risk can be broken down into three types – pluvial, fluvial or coastal – however not all data providers will necessarily differentiate using this level of granularity. Their respective strengths may also lie in different regions. As a result, you likely want to work with multiple data sources to gain a composite view for a particular scenario. One recommendation is to harmonize data from multiple sources to the event types used by the World Meteorological Organization (as shown in the accompanying visual).

Once you have established a standardized risk profile based on sector, risk approach and event type, it becomes relatively easy to perform what-if analysis for a specific investment and determine its suitability for your portfolio from a physical risk exposure perspective.