Credit spreads of various types are loaded into market data systems. They are used primarily for onward publishing to valuation and risk systems. They can also be used within the market data system to calculate bond proxy prices. This week’s note discusses credit spreads in the context of FRTB, CVA, and the multi-curve valuation framework.

In the banking book, credit risk is handled through adjustments to a bank’s BS and P&L statements. The finance department accounts for potential credit events by creating an impairment reserve in the P&L, which corresponds to an offsetting reduction in the debtor balance. However, if the debt is held in the trading book, the financial markets make the necessary adjustments instead. The reduction in credit quality of, say, a bond it has purchased, leads to the bond’s price falling, an unrealised loss, and a lower valuation on the BS. The fall in the bond’s price, by definition, means an increase in the bond’s yield. The increase in yield is the additional compensation that the bank demands due to the increase in credit risk of the bond’s issuer.

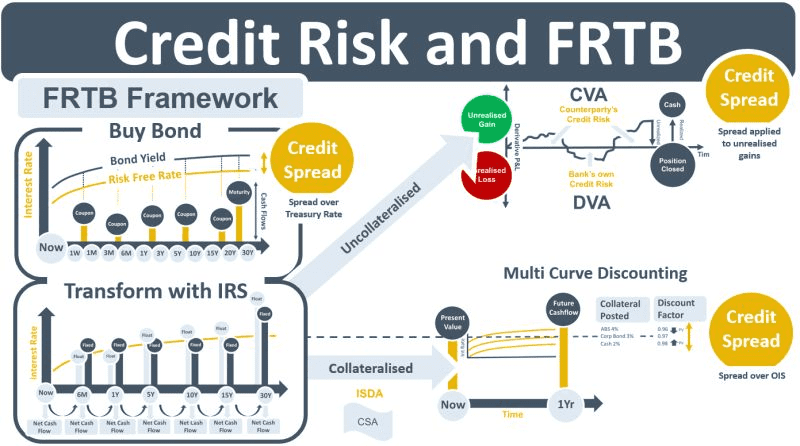

The difference between a bond’s yield and the risk-free rate is the bond’s credit spread (CS). FRTB is a market risk regulation that ensures that banks have sufficient capital set aside for adverse changes in market prices. Credit spread (CS) is categorized as a risk factor under FRTB. The P&L impact of a 1bps change in a CS is called the CS risk sensitivity or CS01. FRTB SA provides CS shocks that are multiplied by the CS01 $-exposures to calculate market risk capital. In the FRTB IMA, the CS shocks are calculated using a time series of CSs, simulated either by using historical data or by using a Monte Carlo model whose parameters are calibrated to the historical data.

A bond’s price contains both IR risk and CS risk. The CS risk in FRTB refers to exposures to changes in CSs in bonds held. The CS measures the market’s perception of the bond’s credit risk. It can be measured in several ways: 1) CDS spreads, which are the cost in bps of insuring against the default of a bond, 2) the Z-spread, which is the CS that makes a bond’s internal rate of return generate a bond price equal to its market price, 3) the ASW spread, which is the cost in bps of swapping a bond’s fixed rate into a risk-free floating rate, and 4) a treasury CS, which is the difference between a risk-free treasury yield and the bond’s yield. The type of CS used depends on the valuation or risk objective as well as on the availability of market data.

The use of CSs for managing credit risk also occurs outside of the FRTB framework. If a bank’s customer wants to transform a bond’s floating rate into a fixed rate, it will buy an IRS from the bank. The IRS can be traded on an uncollateralized or collateralized basis. An unrealized gain on the uncollateralized IRS creates a credit risk exposure to the customer. The bank manages the exposure by taking an upfront insurance payment, referred to as a CVA charge, at trade initiation. Collateralized derivatives, on the other hand, do not contain credit risk if margin payments are posted daily in cash. Where the margin is posted using bonds or other non-cash assets, the multi-curve valuation framework adjusts for credit risk contained in the collateral by discounting the derivative’s cash flows using higher CSs, resulting in a lower IRS valuation.