Investment management software platforms

Many asset managers opt for integrated investment management software that supports multiple functions across their business.

As is to be expected, the numerous platforms on the market offer a spectrum of functionalities and capabilities:

- Handling asset classes relatively stronger or weaker than others

- Automating greater or fewer business processes across trading, risk, performance and reporting

- Achieving real functional integration or appending modules following the takeover of another software company

- Consuming multiple data sources with more or less ease

- Working more or less smoothly with other systems and outsourced services

- Designed to be flexible or one-size-fits-all

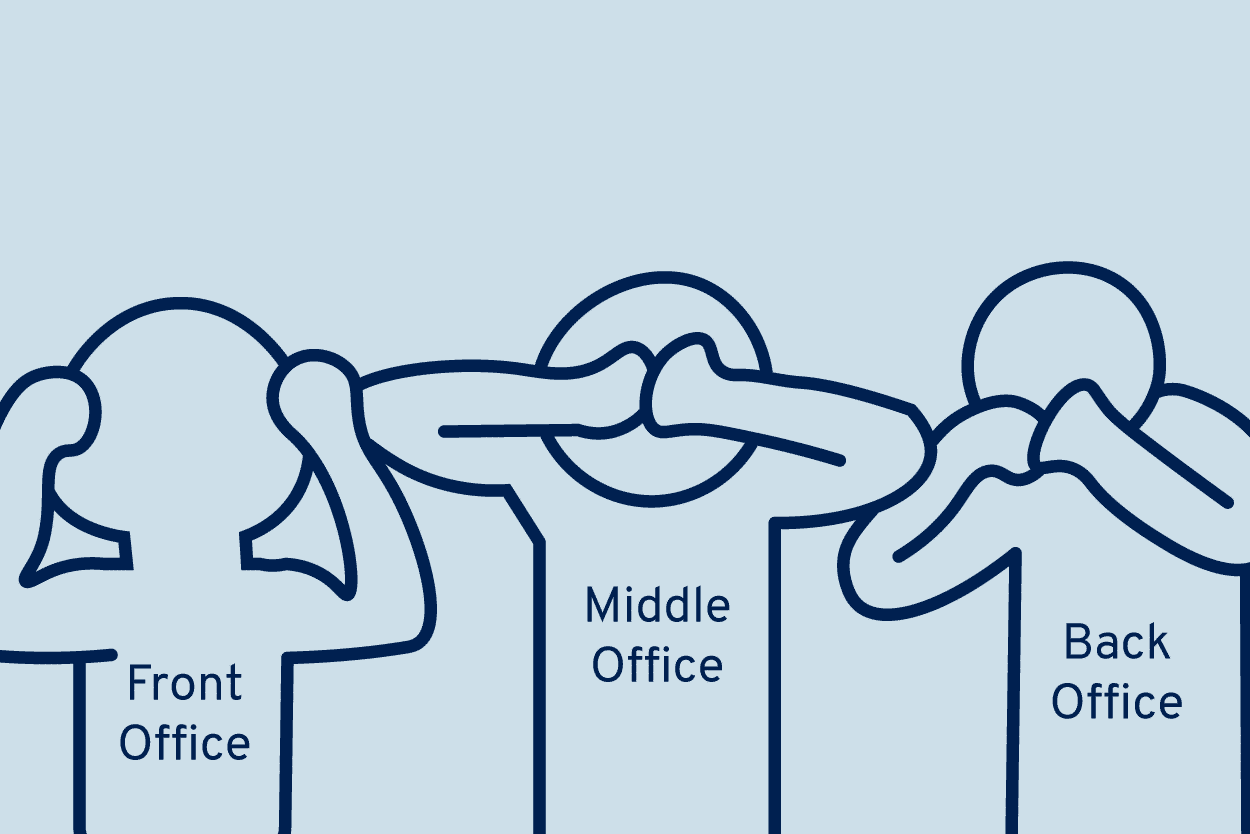

All investment management software platforms bring some level of standardisation across the front, middle and back offices. A common set of tooling for getting things done across the firm creates internal efficiencies.

Data management within investment management software

Although data is routinely uploaded, passed between functional modules and used throughout the business, investment management software platforms often have gaps in their investment data management capabilities. This is because the heritage of many platforms is the functional expertise and practitioner experience of the founders of the investment management software company. The focus is business functionality, not data discipline.

This lack of data discipline is felt by asset managers in a number of ways:

- Legacy investment management software was built for the traditional approach of end of day batch processing using only one source of reference and pricing data for each instrument type. But with the growing desire among many firms to create a gold copy from several data sources, and with the proliferation of data feeds for alternative assets, such inflexibility by design becomes a hindrance. Swapping data sources becomes a significant, bespoke reimplementation effort that detracts from the business case for adopting the new feed.

- Where multiple data sources are required, significant workarounds need to be developed. For example, where a data vendor is known to have some coverage or quality issues, a smart data management approach is to use a ‘vendor source hierarchy’ to automatically select the best data fields from each data feed to populate the gold copy. Investment management software that doesn’t natively allow a preference of available sources to populate the gold copy result in client specific work arounds involving complex, hidden logic, making the system more cumbersome to manage and maintain

- Maker-checker (4 eyes principle, 6 eye check) processes support established methods of control and compliance. They exist to mitigate operational risk, and each firm needs the flexibility to apply them in the right way for their business. But if the workflows for these approvals are fixed and rigid within the investment management software, concessions have to be made, introducing sub-standard controls and potential vulnerability into day-to-day operations. Good data management practices demand flexibility to configure the number of steps and precise user workflows that deliver on the policies and procedures that give customers confidence in the governance of the firm.

- Data lineage, the knowledge about data origin and what has happened to it over time, is key for tracking and tracing errors as well as for satisfying audit, compliance and regulatory oversight. If the underlying lineage rules are coded into the investment management software or the information about the lineage is not easily available to relevant end users, issues around data integrity can go unnoticed and business processes can be compromised. With individual accountability for actions and decisions often sitting with named persons with a firm, visibility of the lineage and the rules that determine how lineage is maintained need to be accessible and visible.

- Despite automation and the advent of artificial intelligence and machine learning, it’s people that run firms. There will always be times when experts use their professional judgement, under the constraints of permissions, checks and approvals, to override what’s in the system. Much legacy investment management software is designed on the assumption that once a data point has been introduced into the system it remains as-is. When it is used in a process an additional data point is created, leaving the original unhanged and ready to be used in another process. Correcting erroneous data then becomes a challenge for business users. Modern data stewardship necessitates that authorized users can manually update rule-derived data and lock it, with the system generating an automated audit trail of the change that was made.

Complementary data discipline to bridge the gap

Fortunately, for those who have an investment management software platform, the discipline of data management is complementary. It not only helps the firm run smoother regarding day-to-day operations, but it also introduces greater choice of target operating model. Adopting outsourced services is easier when you have the proficiency to handle multiple sources of data to and from service providers and internal systems. This also makes it possible to comfortably add best-of-breed business systems to help break into a new asset class. And when selecting the optimal data source for some new benchmarks, firms can be confident that the mechanism to ingest the new feed is already automated and available to them, ensuring both a faster time to market for the firm and also the assurance that the new data will always be available to users when needed, even if the data vendor evolves the structure of the feed.

Integrated data management and investment management

Proven data management solutions have been integrated with many upstream and downstream systems over the years, supporting myriad system landscapes across financial services firms. Integrating with your investment management software is a guided process that also takes into account how to remove the data-related workarounds that you’ve lived with for too long. The subtlety of modern data management solutions is such that nuanced rules residing in your investment management software, which allow you to manage tasks exactly the way that the system requires, can be replicated in the data management solution. This means that the way data is used for portfolio management will not corrupt the gold copy being used for other purposes.

Firms looking to make their data a true business enabler are demanding both flexibility and efficiency. Regardless as to whether the investment platform or the data management solution is to ultimately store the single source of the truth, having the proficiency to create and manage that truth is fundamental. Any gaps in that proficiency become a risk to the business. Bridging those gaps not only reduces risk but introduces greater choice for the management team over where they take the business next.