Arguments for an FRTB data pool

The Fundamental Review of the Trading Book (FRTB) is due to come into force between January 2022 and January 2027, depending on the national regulator in question. It will bring reforms designed to address the shortcomings of Basel 2.5 which failed to address key structural shortcomings in the market risk framework. As the industry prepares to meet this next wave of wide-ranging regulation, much conversation has revolved around the use of the FRTB data pool to alleviate brand new requirements around non modellable risk factors.

Under the requirements of FRTB, for the first time, banks will be required to prove that risk factors trade by retrieving real prices. This is a mammoth undertaking and the question of where banks are going to get this data, is one of the compelling arguments for data pooling. The idea being that banks, data vendors, exchanges and trade repositories, would combine all of their data in order to ensure a robust number of transactions.

Knowing the unknowns

It’s a convincing proposition, banks simply do not have enough of their own data. Add to this the fact that data is expensive, and that many firms are keen to consolidate costs after several heavy years of regulatory requirement, and the attraction is clear.

At this stage, it’s difficult to predict how this solution would play out. Would a single vendor become a one stop shop or would banks be reluctant to rely on a single source and instead spread the risk by enlisting multiple vendors?

Then there is the question of who will be responsible for working out if a risk factor is modellable or not. Though we are still a couple of years away, early indications show that many banks may not be entirely confident relying on the data pool for these calculations, instead looking to their own methodologies and processes.

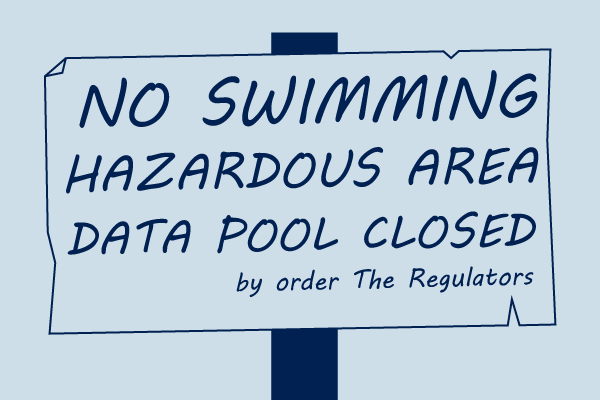

And there are other drawbacks. Under the stringencies of FRTB the regulator may require banks to show, several years later, where they got the pricing data to determine that a risk factor was modellable. If this information came from an FRTB data pool, will the data pool be able to provide the necessary auditability and approvals required. In other words, if a data pool says that a risk factor is modellable, will they then have the capacity, and accept the responsibility, to face off any tough questions from the regulator further down the line?

FRTB data pool vs FRTB data strategy

But though the logistical framework surrounding non modellable risk factors and the Risk Factor Eligibility Test (RFET) are important hurdles to overcome, banks should be wary about ploughing too much time into solving what is only one small part of a much wider reaching set of rules.

The temptation to focus primarily on tackling the RFET likely lies in the fact that it is the only part of FRTB that is completely unprecedented. However, banks should avoid expending all their resources trying to solve this single aspect and instead think about how addressing the whole of FRTB can benefit their overall data strategy.

Because the guidelines are so wide ranging, if you get your data strategy right for FRTB then you will automatically address the data requirements for a lot of other regulations e.g. BCBS 239, Prudential Valuations and the Comprehensive Capital Analysis and Review (CCAR) regulatory framework. This is a massive opportunity for firms to evaluate their entire data infrastructure and ensure that they are taking a holistic approach to regulation rather than addressing different directives in silo. The last few years have seen a “bolt on” approach to regulation with compliance teams addressing different regulations with different solutions and to different timelines.

Address FRTB completely

As with any new regulation, the temptation with FRTB is for banks to focus largely on the aspects which are new and unknown. This is why the conversation around FRTB data pools as a solution to non-modellable risk factors has become so prominent. But firms who put too much time and resource into addressing this one aspect could be missing a trick. In many ways FRTB is an opportunity for compliance teams to take a step back, take stock and put together a comprehensive data strategy that protects them against multiple regulatory requirements, as well as future proofing them for years to come.