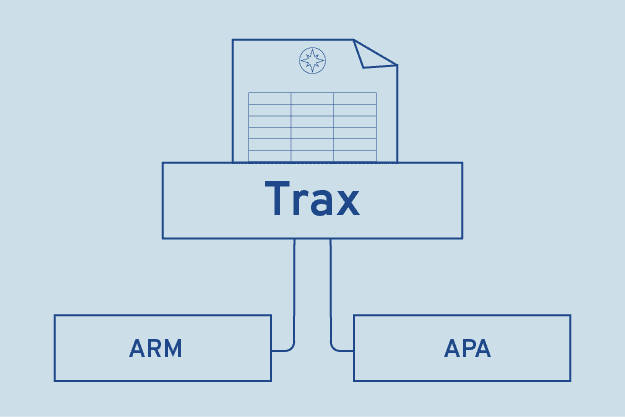

GoldenSource has announced that they have integrated Approved Reporting Mechanism (ARM) and Approved Publication Arrangement (APA) services from Trax, the post-trade services and European market data division of MarketAxess, to help banks and asset managers with their MiFID II reporting obligations.

The integration was developed in Q3 and Q4 of 2017, ahead of MiFID II go-live in January 2018.

What the integration means for firms

It means that firms who manage MiFID II reporting data through GoldenSource now have the option for the data to be automatically submitted to the Trax ARM or APA, helping ensure efficiency and reporting accuracy. In addition to helping manage the increased MiFID II reporting obligations, the solution is also scalable to serve as the operational basis for meeting the requirements of other regulations such as the Securities Financing Transactions Regulation (SFTR). SFTR is the latest big data collection exercise for the market, as intricate details behind a repo or margin loans now need to be captured and reported to an EU trade repository.

Volker Lainer, vice president of product management at GoldenSource said: “What we are offering is a single way for market participants to meet their MiFID II reporting requirements in an efficient and consistent manner. While ESMA is expected to show a degree of leniency to those who scrambled to be ready for the January deadline, firms should be using this time to ensure their MiFID II capabilities are fully up to speed. Our platform can help smooth this process with a standardised approach which is also prepared for other regulations, such as SFTR.”

Nick Moss, head of product management at Trax added: “MiFID II brought significant operational change to the industry, covering a range of new reporting fields, capturing a broader set of asset classes and impacting a wider range of participants. Leveraging integrated solutions, such as the link between Trax and GoldenSource, can help firms streamline their operational processes and have greater control of their reporting integrity.”

About Trax®

Trax is a leading provider of capital market data, trade matching and regulatory reporting services to the global securities market. Trax processes on average over 1 billion annual transactions on behalf of its community of over 600 entities including approximately 12 million fixed income transactions. Trax operates an Approved Publication Arrangement (APA) and Approved Reporting Mechanism (ARM) for MiFID II trade and transaction reporting in addition to providing support for other regulatory regimes. Trax additionally provides capital market firms with information to assist them in conducting net asset valuations, mark-to-market calculations, fixed-income portfolio mapping, liquidity and volume modelling, as well as reference data population updates. Trax data products include a universe of over 300,000 fixed income securities with unique pricing and volume information on approximately 60,000 individual bonds.

Trax is based in London and was originally established in 1985. Acquired by MarketAxess in 2013, Trax is a trading name of Xtrakter Ltd. and is a wholly owned subsidiary of MarketAxess Holdings, Inc. For more information, please visit www.traxmarkets.com.