Credit ratings are coming up frequently in my conversations with our customers, so this week, I thought it would be good to provide some thoughts on what to consider when subscribing to them.

There are the ‘Big Three’ agencies, S&P, Moody’s and Fitch. (Together with Morningstar DBRS, they’re sometimes listed as the ‘Big Four’.) Each has their own delivery mechanisms. Additionally, there are numerous regional credit rating agencies around the world, including Germany, Italy, France, Canada, Korea and Japan, to provide ratings specialized in – but not only for – their domestic companies. And many other data vendors (including the large usual suspects) are acting as redistributors for those rating providers.

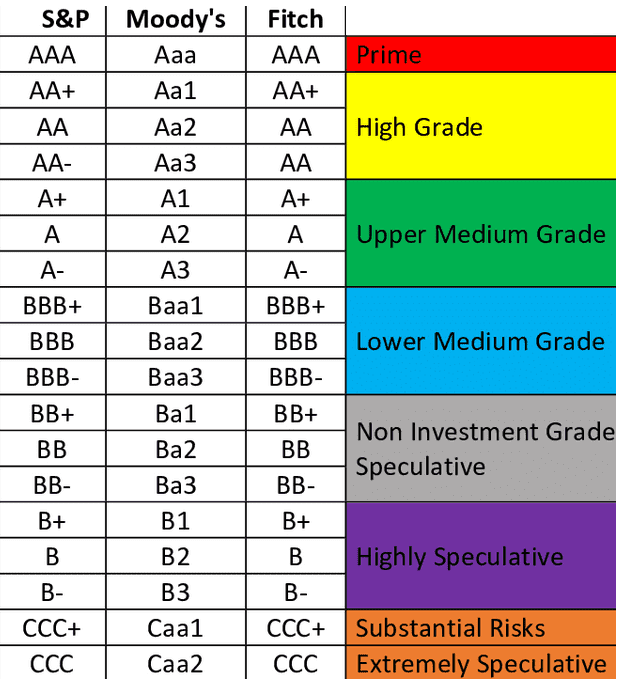

Hardly anyone relies on one single credit rating agency only – typically it is a combination of providers. (By the way, when we say ‘credit rating’, we don’t just mean the usual long-term and short-term ratings, but also probability assessments, whether/how the company’s ratings may change, the Credit Watch and Rating Outlook.)

The majority of GoldenSource clients use all of the Big Three, and several are adding at least one regional data provider, such as DBRS in the Canadian market. The question is typically whether to onboard those ratings directly from the agency itself, or via (one of) your security master or entity master providers instead.

Accessing the data directly from the agency means getting the complete rating data immediately from the horse’s mouth, or at least as soon as possible.

Redistributors have processing times and cut-off times themselves which may add some lag, particularly when dealing with newly rated instruments or issuers. A redistribution may also focus on the most commonly required rating data points, as opposed to the full depth of the rating services.

For Issuer ratings, a decisive criterion is the entity ID scheme(s) your issuer master is based on. When leveraging direct agency rating feeds, some form of entity matching always needs to be implemented. (A topic for another conversation, but this does require prudent upfront consideration!)

Redistributors on the other hand typically align the rating agencies’ proprietary Issuer IDs to their own entity ID scheme automatically, sometimes paired with other value-add such as a composite rating.

Depending on the agreement – and irrespective of the actual data license with the respective rating agency – this is required in any case) such extra services may come at an additional fee.

There is no single best way, as either one may be more suitable for your data ecosystem. Our strong recommendation, however, is to take all these aspects into account first, before deciding on the route that is most suitable for you when enriching your Security Master and/or Entity Master with comprehensive high-quality ratings.