To calculate an end-of-period valuation, a price is required. Prices can be obtained from liquid traded markets or backed out of transactions. When there is a lack of liquidity, prices need to be derived. The use of proxy pricing is a common method for price derivation.

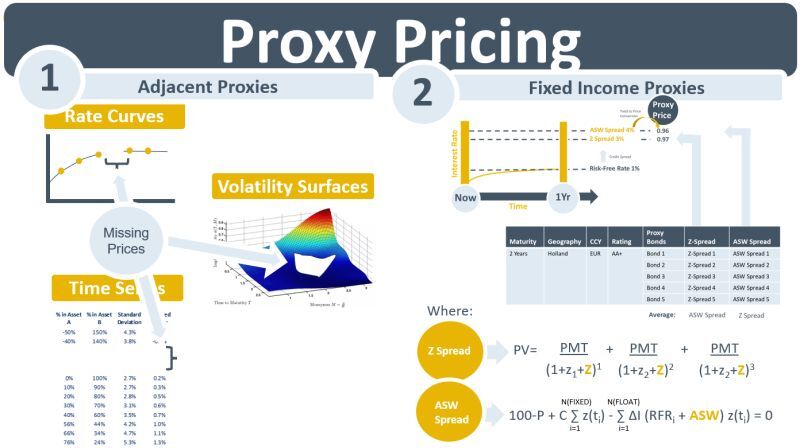

Traded instruments can be used as proxies for illiquid instruments if their price histories can be shown to be highly correlated. However, correlation calculations require time-series data and are typically not part of daily automated proxy pricing processes. Instead, the instrument’s data attributes are compared to identify proxy candidates. Two approaches for proxy instrument identification are 1) adjacent proxies, and 2) fixed income proxies.

Adjacent proxies are instruments that belong to curves or volatility surfaces. Because rates or volatilities that belong to a given curve or surface are usually very similar and move in parallel, adjacent points on these data constructs can be used as proxies. An interpolation method is often used to calculate the price for the missing curve points. The adjacency concept can also be used when managing time series data where gap-filling is required. Again, interpolation can be used to take advantage of the fact that prices for adjacent historical dates are almost always very close to each other.

For fixed income instruments, the identification of proxy bonds for an illiquid instrument involves first finding instruments that have similar characteristics, for example, instruments with the same currency, credit rating, sector and potentially maturity banding and issuer. In the example below, five bonds are identified as proxies. Due to differences in coupon rates and maturities, however, their prices cannot be compared directly, so an extra step is required to calculate the proxy prices. The credit spreads of proxy bonds, usually available on market data feeds, are used to derive proxy prices using the appropriate yield-to-price conversion routine. Because the bonds share the same risk characteristics (sector, credit rating, issuer, currency), their credit spreads are assumed to be the same, irrespective of their coupon rates and maturities. Asset swap spreads and Z-spreads are commonly used for credit spread comparisons in fixed income proxy pricing.