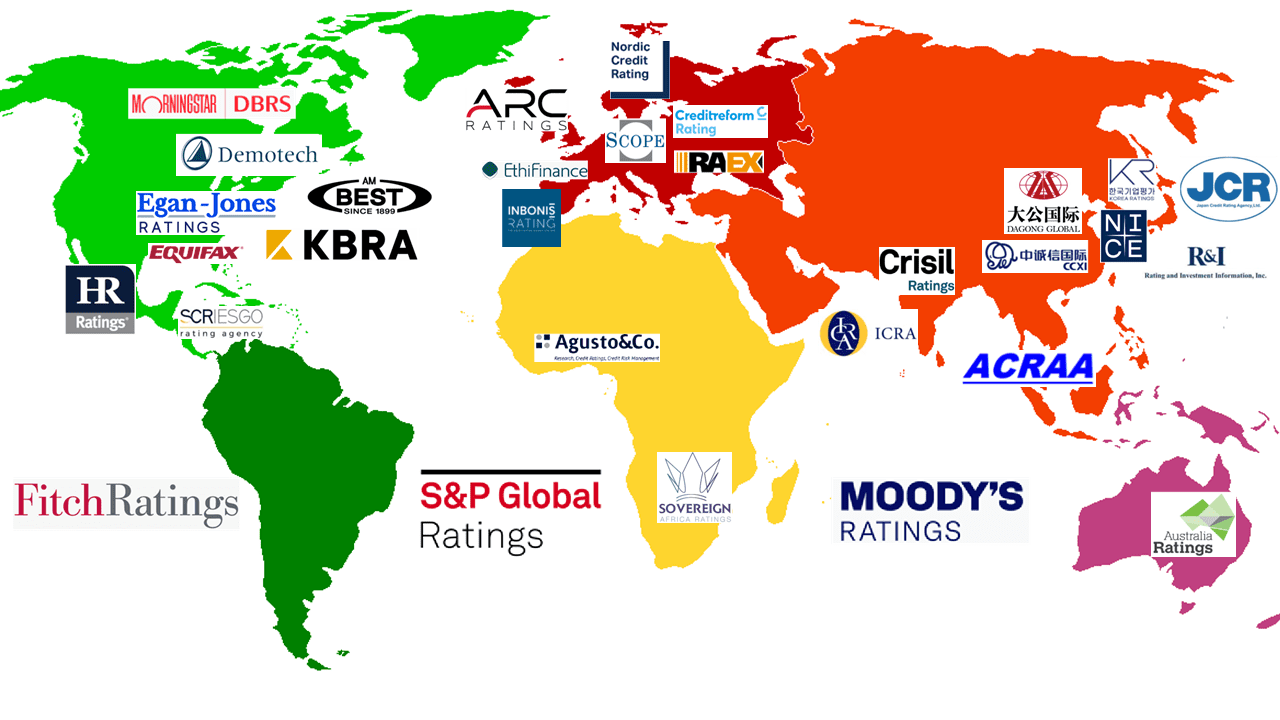

This week in my credit ratings series, I want to talk about the market for ratings providers and agencies and what it looks like.

Everyone knows S&P Global Ratings, Moody’s Ratings (f/k/a Investor Service) and Fitch Ratings, and for a good reason: they own in total up to 95% of the ratings market according to most measures. If you add Morningstar DBRS (Dominion Bond Rating Service) – the fourth-biggest player, albeit by a distance – the combined market share goes above 95%.

Even so, you don’t necessarily have to rely solely on them.

In addition to the Big Three (or ‘Four’) above, US regulator SEC has designated six more organizations as NRSROs (Nationally Recognized Statistical Rating Organizations). This designation makes them officially recognized as providers of reliable credit ratings for SEC regulations pertaining to the financial market, including:

- AM Best

- Demotech

- Egan-Jones Ratings Company

- Fitch Ratings

- HR Ratings

- JCR (Japan Credit Rating Agency)

- KBRA (Kroll Bond Rating Agency)

- Moody’s Ratings

- Morningstar DBRS

- S&P Global Ratings

Many countries also have domestic rating providers, each of which is accredited by the regulator of its respective country.

While the globally operating incumbents also provide certain national and regional scale ratings, given their specialization for one or a few countries, those national and regional agencies serve the purpose of augmenting with ratings specifically for issuers of those countries. These include (not exhaustive):

- ARC Ratings – UK and EU

- Rating-Agentur Expert RA GmbH – Germany, focusing on emerging markets

- Dagong Global Credit Rating and CCXI (China Chengxin Credit Rating Group) – China

- Scope Ratings GmbH – European rating agency (headquartered in Berlin)

- Creditreform Rating AG – Germany (also for the broader European market)

- Ethifinance Ratings, S.L. and Inbonis, S.A. – Spain

- NCR (Nordic Credit Rating) – Denmark, Finland, Iceland, Norway, and Sweden

- R&I (Rating and Investment Information, Inc.) – Japan

- SCRiesgo – Central America and select Caribbean countries (now part of Moody’s Local)

- Equifax Australasia Credit Ratings Pty Ltd and Australia Ratings – Australia

- CRISIL (Credit Rating Information Services of India Limited, now part of S&P) and ICRA (Investment Information and Credit Rating Agency of India Limited, now part of Moody’s) – India

- NICE (National Information & Credit Evaluation) and KIS (Korea Investors Service) – South Korea

Africa is a relatively new market for domestic ratings agencies. For example, SAR (Sovereign Africa Ratings) specializes in South Africa and Agusto & Co. specializes in Nigeria. Both also cover other African countries. And in the Asia-Pacific region, there are several more domestic rating agencies organized under ACRAA (Association of Credit Rating Agencies in Asia).

Most of these agencies offer direct integration of their assessments, and/or they leverage large financial data firms to redistribute some of their content.