All of our Curve Master implementations involve interest rate curves of different types. After the global financial crisis of 2008, the types of interest rates that are available on these curves changed fundamentally as banks re-assessed the concept of what a risk-free interest rate is. One of the changes that emerged is the multi-curve framework. The email today discussed the background to this.

The Multi-Curve Framework and OIS Discounting

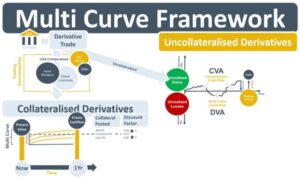

A derivative’s future cash flow (CF) is accounted for in the trading book by discounting it to its present value (PV). The cash flow has two risks, market risk and credit risk. Market risk arises from the movements in the derivative’s underlying rate. If the rate moves in the bank’s favour, an unrealised CF will be owed to it. The second risk associated with the derivative is credit risk. The unrealised CF exposes the bank to counterparty credit risk. This credit risk is adjusted for by increasing the interest rate that is used to discount the derivative’s expected CF to its present value.

But which interest rate should be used to discount the CF? Prior to the financial crisis of 2008, a derivative’s future CF was discounted using interbank lending rates, known as IBOR rates. They were used to construct a single risk-free yield curve for the currency. However, when banks collapsed interbank lending rates were no longer deemed free of default-risk. The industry sought an alternative to IBOR-based yield curves.

To replace the IBOR yield curves, a number of new approaches emerged. One of them was CVA. Banks started charging their trading counterparties an upfront amount for the credit risk on uncollateralised derivative trades. The charge is taken as an insurance premium for loss that would occur if the counterparty fails to pay the unrealised gain it owes to the bank. The charge became known as a credit valuation adjustment (CVA). Next, use of credit support annexes (CSAs) in derivative contracts became standard for larger trading counterparties. CSAs allowed the counterparties to post collateral for the unrealised gains. Finally, the discount factors (DFs) applied to the derivative’s future CFs began to factor in the credit-quality of collateral posted. In the example below, a corporate bond is posted as collateral. The interest rate of the corporate bond is 3%, so a discount factor of approximately 0.97 is used to calculate the PV of the derivative’s CF. If a more credit-risky, say 4%, asset back security (ABS) was used as collateral, then a 0.96 DF leads to a lower PV for the derivative. If cash was posted then the lower 2% cash deposit rate would result in a higher PV based on a 0.98 DF.

A CSA-aware framework evolved from this. RFRs for different maturities are now taken from risk-free yield-curves built using overnight index swap (OIS) rates. The rates are considered risk-free because the overnight indices include only one night’s credit risk. The process is known as OIS discounting. Different discount curves are constructed using spreads above the OIS curve. The spreads are related to credit-worthiness of collateral. These CSA-aware curves are the basis for the multi-curve framework.