You may remember I wrote about Physical Risk data a few weeks back, happening to use Flood Risk as an example.

One month later, a vast flood disaster hit Central Europe. Despite extensive improvements following previous ‘centenary’ floods, there was massive damage to businesses and personal assets.

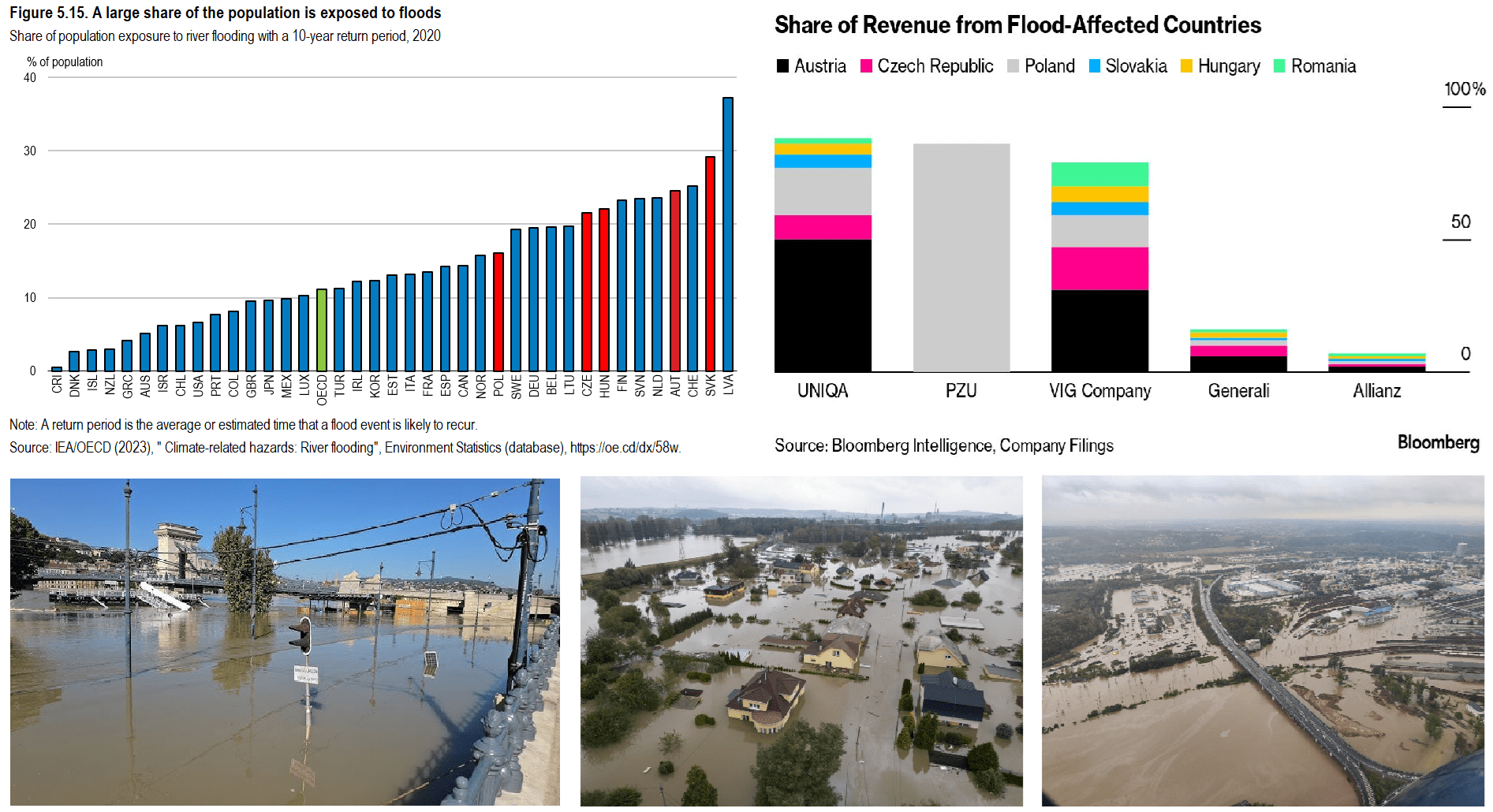

According to reinsurance broker Guy Carpenter, the estimated market losses are €1.6 to €2.1 bn ($1.8 to 2.4 bn). Including infrastructure damage, Reuters reports damage estimates of up to $10 bn in the Czech Republic and Poland alone, with a lasting shortfall to the countries’ economies.

Insurers and reinsurers are now assessing the consequences. Insurance premiums will certainly rise further for businesses, and there are indications that certain risks may not be insurable anymore.

For years, OECD and IEA had forecasted severe exposure to floods for these very countries. In fact, the granular risk projections for regional, company and property levels provided by specialized data providers provide undisputable proof of just how essential the management of physical risk data has become – even for mid-term investment planning. It is well worth making it a part of any financial data management strategy