Very often, ESG performance data can be difficult to find – but not impossible.

By proxying adjacent data sets, you can ascertain insights into specifics concerning an instrument’s activities regarding, for example, environmental protection, or labor rights, or anti-corruption.

There are three main ways to utilize proxies in order to gauge ESG performance.

The first is to proxy from the issuer. While the ESG data point you need may not specifically pertain to a specific instrument, it is possible to examine metrics of the overall organization’s performance in, say, emission controls.

The second is to proxy from an industry benchmark data provided by an industry association, government body, advocacy group, or independent data provider. By applying baseline information you already have, such as the company’s sector, company size and objectives, or geographic jurisdiction, you can then tap into adjacent benchmark data that can offer a perspective on an instrument’s performance in a specific ESG area.

And the third way is to proxy from legal entity hierarchy data. Instrument-level ESG data tends to be more sparse than company-level ESG data, so the exercise becomes garnering insights at the higher legal entity level to hone in on the requisite data point.

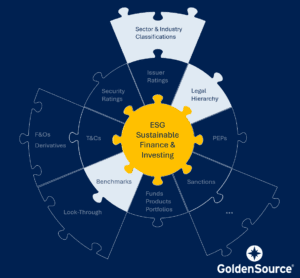

Ultimately, the goal is to bring an instrument’s or issuer’s ESG performance into clear focus, As I mentioned last week, the gold standard of meaningful proxying is being able to derive missing information by consulting multiple corporate and capital structures, and looking at different benchmarks and classification schemes: horses for courses.

Certainly, the data providers that specialize in ESG data are vital contributors, but it’s absolutely worth considering additional data avenues to maintain a resilient ESG portfolio.