I have recently written several notes about different aspects of FRTB. I also looked at the concept of regulatory capital, risk-weighted assets and the trading book. This week’s note seeks to bring a number of these threads together and explain them in the context of the overall FRTB document.

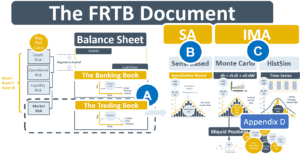

The FRTB Document

If you have a mortgage, your capital is the difference between the value of your asset, the property, and the loan you received to buy the asset. Regulatory capital is a related but different concept. It is the capital, i.e., a bank’s own money, that it must set aside for a particular type of risk. The four main types of risk a bank is exposed to are credit risk, operational risk, liquidity risk and market risk. Required capital ratios are typically calculated using the formula: capital divided by risk-weighted assets (RWAs). The formula is designed so that less risky assets require less capital. The rules for calculating RWAs are specified in the Basel documents. The document containing the market risk rules and related trading book control requirements is the FRTB document, published in 2016.

On a bank’s balance sheet, there are two books, the banking book and the trading book. The P&L in the banking book, when plotted on a chart, is a straight line representing the interest differential between money lent and money borrowed. The P&L in the trading book is determined by fluctuations in market prices. When plotted, it looks random. Section A of the FRTB 2016 document describes the rules for the boundary between these two books.

Market Risk is the risk of losses in a bank’s trading book arising from movements in market prices. The three approaches in FRTB for calculating market risk RWAs are based on value-at-risk (VaR), which uses estimated worst-case P&L days. Section B of the FRTB document contains the formulas for the first approach, parametric VaR, and Section C contains the formulas for the other two allowed approaches, Monte Carlo VaR and HistSim VaR.

The VaR formulas assume that positions are marked at mid-prices. However, positions cannot be exited at mid, they can only be exited at bid or ask prices. Where positions are illiquid and bid-ask spreads are wide, prudential valuation processes such as IPV, bid-ask reserves, Day-1 P&L, early termination reserves, model reserves, and market price uncertainty AVAs are required. Appendix D of Section C of the FRTB document contains guidance on these processes entitled “Treatment for illiquid positions”.