One of the bigger challenges in dealing with ESG performance data is that it comprises such a broad array of subject matter. And while some of that data can be relatively easy to access, others are not.

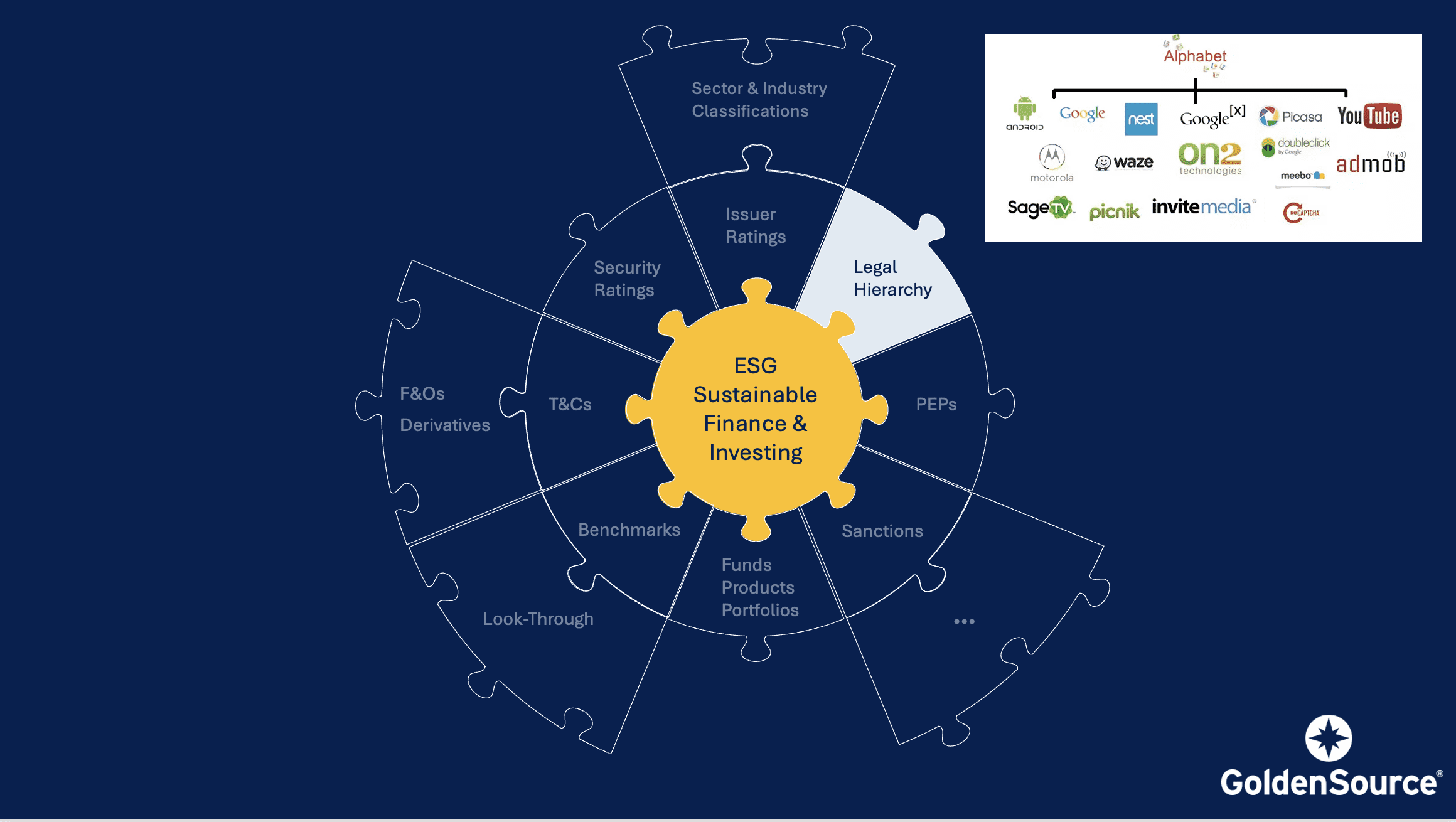

That’s where adjacent data sets come into play, one critical example of which are those that comprise legal entity hierarchy information.

Most specifically, these data sets concern often-needed regulatory compliance related to ESG topics such as environmental protection, labor rights, and anti-corruption activity. At the same time, it also may be necessary to explore issues concerning ownership structure, supply chain operations, corporate governance, and stakeholder engagement.

The goal, of course, is to gain as complete and as clear a picture of investment viability for an ESG portfolio. The best way to achieve this, of course, is to obtain the gold standard – that is having the ability to manage multiple sources of legal entity hierarchy data in parallel. These can include preeminent providers for corporate and capital structure, such as LSEG (f/k/a Refinitiv), D&B, Orbis, ICE, and Bloomberg, in addition to regional providers, GLEIF, and in-house data sources.

Managing and cross-referencing all these data sources together provides you with optimal flexibility to dig deeper, qualify the information in any reporting, and fully track all data sources when required.

It’s not always necessary to perform legal entity hierarchy research, but when it is, it’s essential that the sources of data you’re using will provide a firm foundation in maintaining a resilient ESG portfolio.