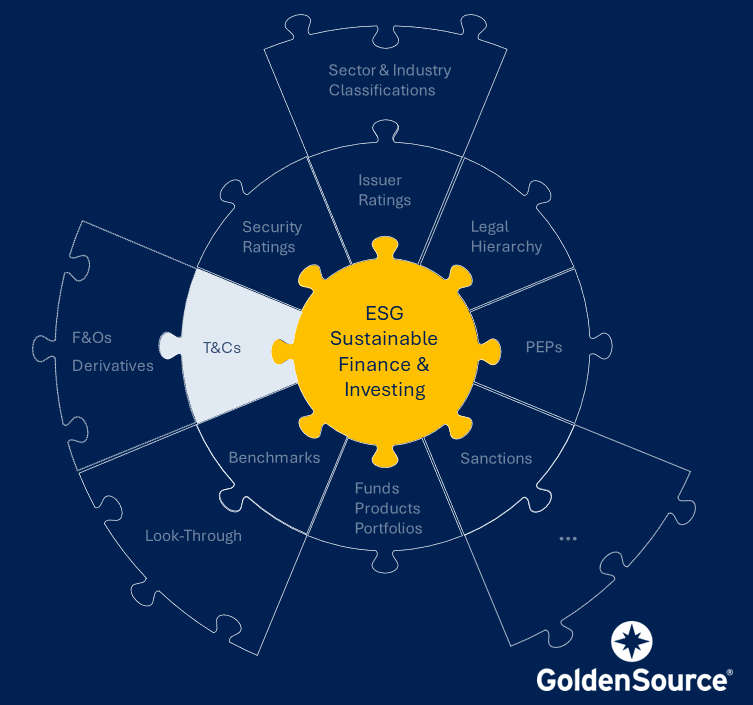

This week, in our ongoing exploration of using adjacent financial information to work with ESG and Sustainability data sets, I want to talk about Terms & Conditions (T&Cs) data.

T&Cs is a vast area – everything from share classes to shareholder rights, issuance and trading, income characteristics, taxation, and applicability to other regulatory requirements – and many of its attributes are essential in arriving at a complete view of a company’s overall sustainability and resilience to assess its ESG investment viability.

To start, any exploration of an instrument’s T&Cs when working with ESG data should be performed alongside a proper security master. T&Cs are not a mere extension of ESG data, they are the basics of the security. The same matching capabilities used in managing ‘classic’ instrument-level T&C data within traditional domains are crucial here, too.

This, in turn, gives you the capability to understand all the issue types and schemes involved. There are, after all, any number of specifics you may need to know in a use case for sustainable investing – for example, when the instrument matures, what its current status is, and where it’s listed.

Very common is the need to deal with ‘related’ instruments – a derivative, for example, and its underlying assets (e.g. stocks, commodities, currencies, real estate, etc.) – with a view into their respective E, S, and G aspects, possibly to roll those up. It may also be necessary to consider the domicile and country of risk of the issuer – the physical and electronic addresses related to an instrument within various geographic regions.

The bottom line? There are hundreds and hundreds and hundreds of data points when it comes to T&Cs, and, of course, they differ from asset class to asset class, and from issuer type to issuer type. Unless you can take those into account properly when performing typical ESG-related functions such as screening, performance assessment and reporting, the picture you see will remain incomplete and less accurate.